Lithium shares have offered investors great opportunities as ASX stocks they can get excited about.

But, the last year has shown that lithium demand (and supply) does not follow a straight line. There might be other ways to play the decarbonisation theme, such as investing in copper shares.

Copper has been a useful resource for humanity for hundreds, if not thousands, of years already. And copper could be a better place to invest, according to Victor Smorgon Group investment manager Ben Salter, as reported by The Australian.

What's going wrong for ASX lithium shares?

Resource prices are typically influenced by both supply and demand. There has been weaker demand for lithium, and lithium supply continues to increase. Pilbara Minerals Ltd (ASX: PLS) is one of those ASX lithium shares that is ramping up its production over the next couple of years.

Salter points out that the share prices of some lithium miners, like Mineral Resources Ltd (ASX: MIN) and Allkem Ltd (ASX: AKE), have fallen significantly.

The investment manager also noted there had been lower-than-expected electric vehicle (EV) production, adding to the pain for lithium spot pricing and short-term supply contracts.

According to Salter, lithium prices are forecast by the OCE to "decline significantly in 2024 and 2025, as the supply of lithium catches up to demand." Australia reportedly leads global lithium extraction, with 50% of global production in 2022.

The investment manager also warned on the long-term prospects of lithium:

Importantly, uncertainty exists in the long-term demand for lithium due to potential technological advancements in extraction, as well the underlying use in electric vehicles. The demand for lithium is very much driven by the economic viability of competing battery technologies.

Lithium-ion batteries are currently considered the most viable due to their low weight and storage and discharge characteristics. However, advancement in lithium-ion alternatives, including sodium-ion and solid-state alternatives, threatens the long-term demand fundamentals for lithium.

Why is copper more attractive?

A more attractive place to look for opportunities are "sectors where strong demand is projected and supply is likely to be constrained", according to Salter.

Copper demand growth is positive with the ongoing adoption of electric vehicles, but also from the building of energy infrastructure and the development of emerging economies.

Despite those strong fundamentals for the copper sector, the investment manager said supply was projected to decrease as it "becomes more difficult to sanction and commission large new copper mines worldwide."

Salter's final thought was that the copper market was "deep and mature" and the substitution of copper in its end uses "difficult".

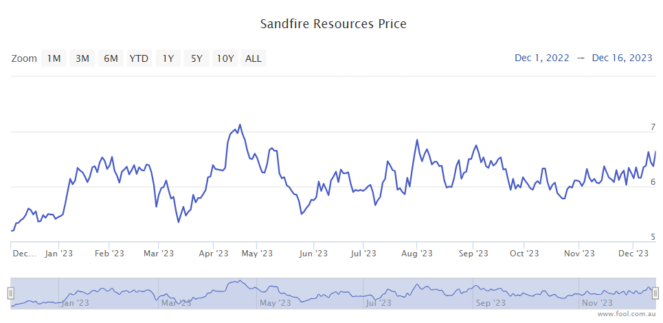

While he didn't specifically mention any copper miners, Sandfire Resources Ltd (ASX: SFR) is one of the largest copper miners I'd point to on the ASX. However, the Sandfire Resources share price is close to a 52-week high, so it's not exactly cheap.