ASX income shares can be the answer for investors looking for a mixture of passive income and capital growth. Is December a once-in-a-decade chance to invest and become rich?

It's really useful when the share price of a dividend-paying business falls. Not only is the share price cheaper but it boosts the prospective dividend yield. For example, if a company with a dividend yield of 5% falls by 10%, the dividend yield becomes 5.5%. A company with a 7% yield that falls 10% has a 7.7% dividend yield.

Is this a once-in-a-decade chance to get rich?

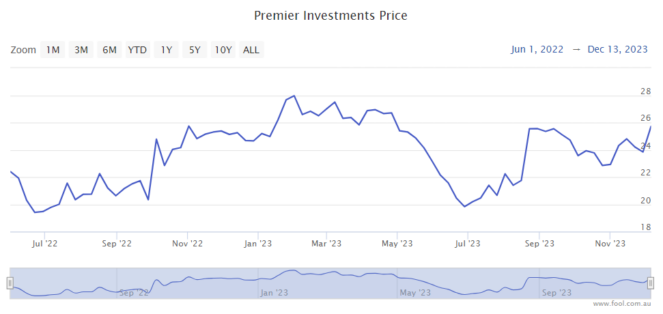

A lot of share prices have bounced from lows seen in 2022, the middle of 2023 and the end of October. Just look at the Premier Investments Limited (ASX: PMV) share price graph below:

Not every company's chart looks like this, but it's a good demonstration.

While it is higher than what it was, the Premier Investments share price is still around 20% lower than where it was in November 2021.

I would say this period over the last 18 months has been a great time to invest and get a better valuation and yield, though it's not the lowest price of the past two years. But, there's no need to try to buy at the lowest price – only people with a functioning crystal ball know when share prices are going to move in the short term.

This isn't necessarily the best time to buy ASX income shares, but it could still be a good time to invest for the long term in opportunities, which offer dividend yields higher than what we can get from a savings account.

I think it's always a good time to invest as long as we choose solid businesses with long-term futures at a good price.

Some ASX income shares I'd buy right now

There are some really good businesses that aren't trading close to 52-week highs which could offer really good dividend income over the long term, particularly from FY25 onwards.

Metcash Ltd (ASX: MTS) supplies various businesses around the country including IGA, Cellarbrations, The Bottle-O, IGA Liquor, Porters Liquor, Thirsty Camel and Duncans. It also owns the brands of Mitre 10, Total Tools and Home Timber & Hardware. According to Commsec, the ASX income share could pay a grossed-up dividend yield of around 8%.

Pacific Current Group Ltd (ASX: PAC) has invested in a portfolio of fund managers around the world who invest across various assets and could grow funds under management (FUM). Commsec numbers suggest it could pay an unfranked dividend yield of around 6% in FY25.

Duxton Water Ltd (ASX: D2O) owns a large amount of water entitlements which can be leased to agricultural operators on short-term or long-term contracts. I think it's a good way to invest indirectly in farming and the long-term growth of the water price. The next two guided dividends could amount to a grossed-up dividend yield of around 6.5%.

Accent Group Ltd (ASX: AX1) is an ASX income share I recently added to my own portfolio. It owns some shoe retail brands including The Athlete's Foot, Nude Lucy, Stylerunner and Glue Store. It also acts as the distributor for many other brands like Skechers, Ugg, Dr Martens, CAT, Kappa, Hoka and more. It's projected to pay a grossed-up dividend yield of around 10% in FY25.

Rural Funds Group (ASX: RFF) is a real estate investment trust (REIT) that owns various types of farmland including cattle, almonds, macadamias and vineyards. In FY24 it's guided to pay a distribution yield of around 6%.