If you are close to retirement, congratulations.

You deserve to enjoy a leisurely lifestyle after decades of toiling hard to put on the food on the table and provide for your loved ones.

Fortunately, Australia is an outstanding place to enter that phase of your life.

That's because this wide brown land has some of the best dividend shares on the entire planet.

Australia has tax laws that heavily incentivise public companies to return capital to their shareholders via distributions over other channels like buybacks.

The rules say that investors should not be taxed twice on dividends. That is, if a company has already paid corporate tax on its profits, dividends coming from that pool should be tax-free.

So in such circumstances, shareholders are given franking credits along with the cash distribution, which allows income tax to be avoided.

That's why retirees are spoiled for choice on the ASX when it comes to generating passive income.

A caveat on the passive income

Of course, this doesn't mean just buying up the stocks with the highest dividend yields.

Every investor needs to be careful with investments that supposedly return double-digit yields, as it could mean the business and the share price could be deteriorating.

There is not much use in receiving a 15% dividend yield if the stock price halves in a year.

Protection of capital is even more important for those in the retirement phase with little recourse or time to make up for losses.

So this does mean sacrificing some passive income for more businesses with more certain outlooks.

Here are three stocks that fit the bill:

Three dividend beauties

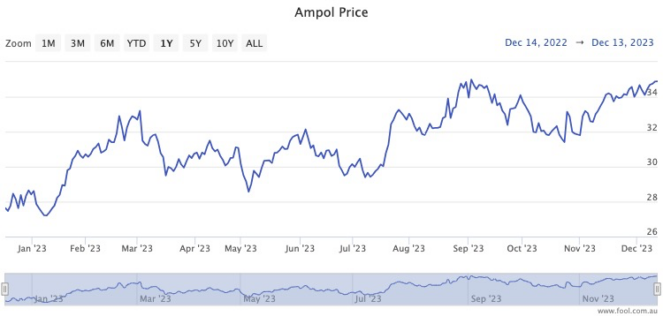

Ampol Ltd (ASX: ALD) operates an oil refinery and a huge network of petrol stations around the nation.

With the world scrambling for energy security in the last couple of years, the stock has risen 27% so far this year and more than 71% since the 2020 COVID-19 market crash.

This is all while paying out a chunky 7.2% dividend yield, which is fully franked no less.

Professional investors love the stock at the moment, with eight out 11 analysts surveyed on CMC Invest rating Ampol as a buy.

As a real estate investment trust (REIT), Growthpoint Properties Australia Ltd (ASX: GOZ)'s dividends come with no franking.

However, it still pays out an enviable yield of 8.6%.

And the property sector is now roaring back to life with interest rate stabilisation — or even cuts — tantalisingly around the corner.

Growthpoint shares have rocketed 31% since the start of last month, but it's still well under the last reported net tangible assets per share of $4.

Four of six analysts covering the stock reckon it's a buy, as shown on CMC Invest.

Global grain supplies had also been under threat after Russia invaded Ukraine last year, and that might explain why the Graincorp Ltd (ASX: GNC) share price has gained almost 70% over the past five years.

It pays out a fully franked yield of 7.3%, including special cash dividends this year. Graincorp also paid special dividends last year.

Five out of nine professional investors recommend Graincorp as a buy, according to CMC Markets.