The stock market seems to have an air of optimism now that it has not had for a couple of years.

With the appetising prospect of a stabilisation — or even a cut — in interest rates, ASX growth stocks seem to be busting out.

So, before it's too late, you might consider picking up some of those shares while they're still cheap.

Because one or two outstanding long-term winners can really supercharge your wealth.

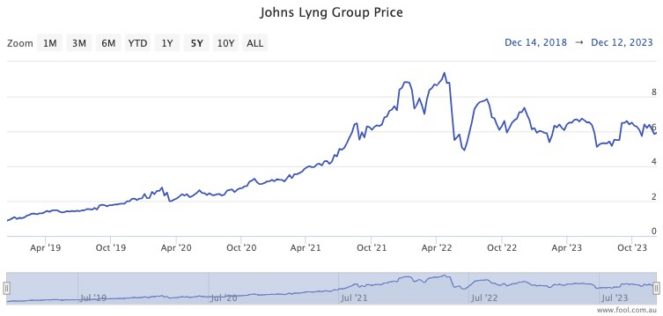

Take Johns Lyng Group Ltd (ASX: JLG) for example.

Those shares were trading in the 80-something cents five years ago, and it is now more than 588% higher, almost touching $6.

That means a $10,000 worth of Johns Lyng shares purchased a half-decade ago would now be $68,800.

That's despite such market disasters like the COVID-19 crash and the 2022 post-pandemic growth selloff over that time.

Johns Lyng could have been in a portfolio accompanied by five other absolute losers and the investor would still be in the green.

ASX growth stocks trading at heavy discounts

Buying growth shares cheaply is an easy way to boost your returns.

Every cent of discount you can manage when buying the stock is a cent that will contribute towards your eventual gain.

Johns Lyng shares themselves are down 11.9% since September, presenting a tempting entry point.

Mining technology provider RPMGlobal Holdings Ltd (ASX: RUL) is currently trading 6.6% lower than its July peak.

But with analysts unanimously rating the stock as a buy, it has rallied more than 8% over the past week. So it won't stay cheap for long.

RPMGlobal shares have gained 185% over the past five years, showing their long-term chops.

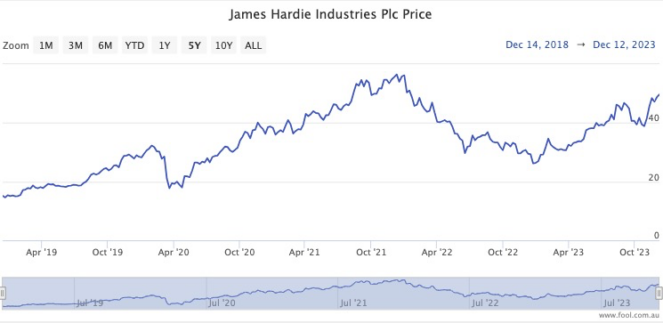

After a 67% boost in the past year, perhaps James Hardie Industries plc (ASX: JHX) is not immediately obvious as a bargain buy.

But it's still more than 12% below its 2021 high, and economic conditions are about to turn favourable for those willing to back the construction materials maker for the long run.

"Higher interest rates are typically negative for US housing. But the difference with this cycle is that a lot of American mortgage owners are locked into 30-year mortgages at very low interest rates," DNR Capital chief investment officer Jamie Nicol said last month.

"They are unlikely to move and will need to repair and remodel their homes, which will be a boon to James Hardie over the next year and a half."

James Hardie shares have returned more than 230% over the last five years.

According to CMC Invest, 10 out of 14 analysts currently believe the ASX growth stock is a buy.