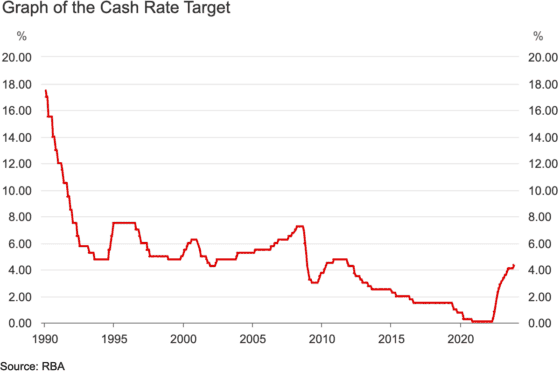

The Reserve Bank of Australia gave Australians an early Christmas present by doing nothing at its board meeting last week.

Are there any other booby traps hiding this week for your ASX shares? eToro market analyst Josh Gilbert picks out the three events with the most potential:

1. Michele Bullock speech

Reserve Bank governor Michele Bullock will deliver a speech on Tuesday at the AusPayNet Summit in Sydney.

Gilbert reckons it's "a key speech for investors to watch".

"The RBA's decision to keep rates on hold last week was no surprise, but the accompanying dovish statement was," he said.

"It will be interesting to see what side of the fence she sits on this week, as any dovish tones will undoubtedly excite the market and lift expectations that we have seen the end of the RBA's hiking cycle."

The RBA board does not meet in January, so it will be a few weeks before the next interest rate decision.

"There will be plenty of speculation on the next rate call either way, given there'll be plenty of economic data trickling in post-Christmas."

2. Australia unemployment

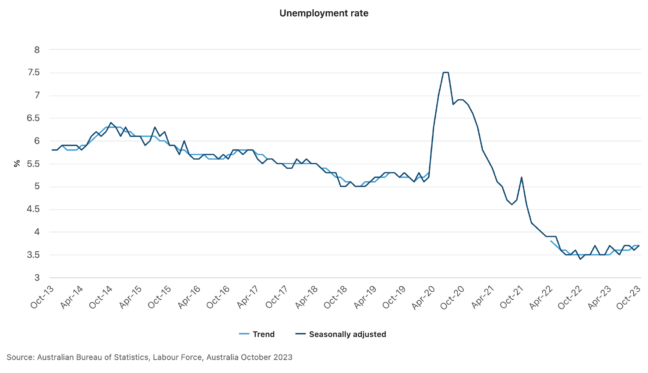

While other economic data has recently moved in the right direction for the RBA, one figure remains troubling.

Thursday will reveal whether the unemployment rate continues to be stubborn.

"The unemployment rate was 3.7% in October, with strong employment growth," said Gilbert.

"This continued tightness has affected wages throughout 2023, and it was evident in the wage price index released for the September quarter, rising by 1.3% – the fastest quarterly rise on record."

However, there were some signs that the job market could cool in the November numbers.

"Job advertisements fell by 5% in October and sat at 19.9% lower year-on-year, according to data from Seek Ltd (ASX: SEK).

"Falling job ads mean less demand for hiring as we head into the new year, which is a firm sign that we may see the unemployment rate rise this week."

Of course, any sign that the jobless queue is lengthening will give the central bank plenty of reason to not raise rates any further. And that will generally be bullish for ASX shares.

3. US interest rate decision

Also on Thursday, the most influential economy in the world will see its central bank hand down its interest rate judgement.

Gilbert suspects the decision itself could be a non-event.

"It [is] widely expected the Federal Reserve will keep rates on hold at 5.25% to 5.5%," he said.

"If this does wind up being the case, this would then shift the focus towards the Fed's statement and chair Jerome Powell's press conference."

Financial markets are pricing in a rate cut as early as March, even though Powell has done his utmost to dampen such enthusiasm, lest it reignite the embers of inflation.

"Before the decision this week, the Fed will receive the latest CPI release, and if we see further progress on inflation, Jerome Powell will then have the undesirable duty of keeping markets in check."