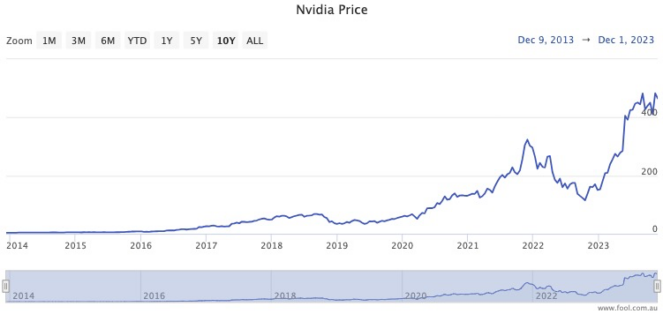

Although Nvidia Corp (NASDAQ: NVDA) has been around for three decades, it has really caught the attention of investors in 2023.

The technology stock has rocketed an incredible 227% so far this year.

The company has gone gangbusters thanks to the enormous interest in artificial intelligence.

Oddly enough, Nvidia itself doesn't produce that technology. It's just that its powerful computer processors have been snapped up by clients wanting to develop AI systems.

It's a classic picks-and-shovels story.

5,600% return since 2015

Over the last decade, Nvidia has made many investors happy and wealthy.

The stock closed on 11 December 2015 at US$8.12. It finished up Monday this week at US$467.65.

That makes it a 57-bagger in less than eight years if you can believe it.

If you held $10,000 of Nvidia shares in late 2015, you'd now be sitting on a cool $576,000.

How good.

Now, is there a stock on the ASX that's capable of such explosive growth?

Past performance is no indicator of the future, but we can take some educated guesses.

Let's take a look at Lovisa Holdings Ltd (ASX: LOV) as a possibility.

Opening stores like it's going out of fashion

Lovisa is a low-cost jewellery retailer that's expanded rapidly in recent times.

DNR Capital portfolio manager Sam Twidale remembers how his fund first bought into it five years ago.

"When we first invested in this stock, it had less than 300 stores in Australia," he said in a DNR video this week.

"Since then, it has grown to over 800 stores, growing its presence internationally."

And that's triggered an impressive 171% rise in the share price, which closed Monday at $19.86.

The great advantage for those buying Lovisa shares now is that this expansion strategy is still continuing in earnest.

Morgans analysts recently pointed out how Lovisa is stamping into new territories as we speak.

"We believe it plans to enter mainland China in FY24, paving the way for significant longer-term growth."

The Motley Fool's Tristan Harrison is a fan too.

"Lovisa has recently entered a number of markets, including Hong Kong, Spain, Taiwan, Morocco, Poland, and Italy. In the next month, it's going to open its first stores in Vietnam and China, both of which have huge populations," he said.

"In the first 20 weeks of FY24, the ASX share's total sales were up 17% year on year, showing that its store rollout is helping scale, which in turn can help overall profit."

Is the dip in Lovisa shares just an illusion?

One huge advantage Lovisa shares have over Nvidia is that it pays out dividends. Right now, the dividend yield sits at a very respectable 3.6%, which is 70% franked.

The Lovisa share price has admittedly dropped more than 26% since late April.

Twidale, who reckons Lovisa's store network is capable of reaching 1000 outlets, reckons this dip in market interest is short-sighted.

"The market is focusing on the short-term metrics like sales growth and impact of weaker consumer spending but is missing the bigger picture opportunity of ongoing store expansion as it continues to diversify internationally."

While no one knows whether Lovisa shares are capable of becoming a 57-bagger over the next eight years, it seems there are plenty of bulls for the retailer at the moment.