You pounce on discounted toothpaste at the supermarket and jeans on sale at the department store, so why wouldn't you do the same for stocks?

The cheaper you buy, the better the returns. It's simple maths.

So here are three S&P/ASX 200 Index (ASX: XJO) stocks that experts have flagged as buys this week:

Long-term investors must take advantage of 'weakness'

ASX lithium shares have been in the doldrums this year, all because of a struggling global economy pushing down demand.

Catapult Wealth portfolio manager Tim Haselum reckons this presents a golden investment window.

"The lithium price has been tracking down and the bottom may not have been reached," Haselum told The Bull.

"But on a long-term view, this weakness presents a buying opportunity given the strong electrification theme."

His lithium pick is Pilbara Minerals Ltd (ASX: PLS), which has seen its share price fall nearly 34% since 10 August.

Haselum's advice is to jump on Pilbara shares as soon as the momentum turns.

"Investors may want to consider accumulating on upwards momentum."

Nine out of 18 analysts currently rate Pilbara Minerals as a buy, according to CMC Invest.

'A brighter outlook' when rates stop rising

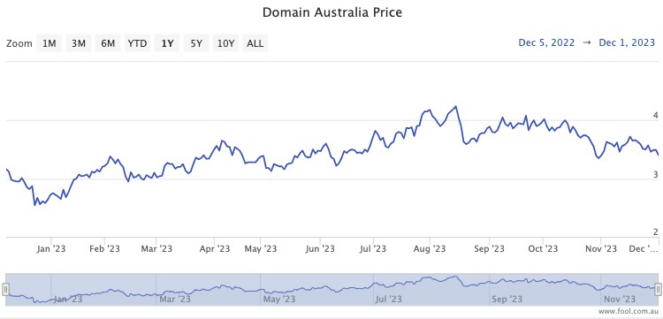

Red Leaf Securities chief executive John Athanasiou's bargain pick is online real estate classifieds provider Domain Holdings Australia Ltd (ASX: DHG).

The ASX 200 stock has plunged almost 20% since 11 August.

Athanasiou reckons it's all upside from here.

"Property prices have recovered from their post COVID-19 dip," he said.

"In our view, we're likely to see stable interest rates, which we expect will support consumer confidence."

Of course, the end of rate hikes is always a boon for the real estate sector.

"We anticipate increasing property listings moving forward, which paints a brighter outlook for Domain Holdings Group."

Chugging along while the board members fight

A board battle has meant alcohol retailer and hotels operator Endeavour Group Ltd (ASX: EDV) has been in the headlines for all the wrong reasons.

And this shows in the stock price, now hovering 28.5% lower than mid-February.

But the business itself is going fine, as far as Haselum is concerned.

"The company delivered sales growth in retail and hotels in the first quarter of fiscal year 2024."

After the fall in valuation this year, he feels like these ASX 200 shares can only head in one direction next year.

"We believe Endeavour presents decent value as downside risk appears to have been already priced into the shares," he said.

"A weaker Australian dollar and softer share price could see overseas investors start to show some interest in Endeavour."

The company is well-liked among professional investors, with CMC Invest showing nine out of 12 analysts currently rating Endeavour a buy.