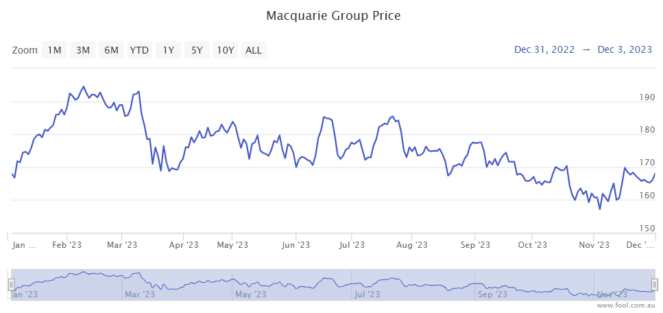

Macquarie Group Ltd (ASX: MQG) shares are almost back where they started in 2023 – below a share price of $170. Could 2024 be a better year for the ASX financial share? Let's take a look.

As readers may know, Macquarie's business is split into four segments – investment banking, retail banking and financial services, asset management and commodities and global markets (CGM).

Profit in the first half of FY24 was not promising for the overall FY24 report.

Earnings recap

The HY24 result showed net profit of $1.4 billion, which was down 39% year over year and down 51% compared to the second half of FY23.

Macquarie's assets under management (AUM) rose 7% year over year to A$892 billion.

The so-called 'annuity-style' activities of Macquarie Asset Management (MAM) and banking and financial services (BFS) and certain businesses in CGM saw a net profit contribution of $1.3 billion, down 43% year over year.

The 'market-facing activities' of Macquarie Capital and most businesses in CGM saw a combined net profit contribution of $1.56 billion, down 32% year over year.

Pleasingly, the company did announce it would use some of its $10.5 billion capital surplus to carry out a share buyback of up to $2 billion, which could be a useful boost for Macquarie shares.

In Macquarie's own words on its outlook, the company said it continues to maintain a "cautious stance, with a conservative approach to capital, funding and liquidity that positions it well to respond to the current environment."

Macquarie CEO and managing director Shemara Wikramanayake said:

Macquarie remains well-positioned to deliver superior performance in the medium term with its diverse business mix across annuity-style and markets-facing businesses; deep expertise across diverse sectors in major markets with structural growth tailwinds; patient adjacent growth across new products and new markets; ongoing technology and regulatory spend to support the Group; a strong and conservative balance sheet; and a proven risk management framework and culture.

Expert view on the Macquarie share price

The broker UBS currently has a buy rating on Macquarie, with a price target of $185. This implies a capital growth of 10% over the next year. But remember, a price target is just a forecast. It's not guaranteed to happen.

UBS suggests Macquarie is going through a normalisation of earnings closer to FY21 levels, and it's seeing cost increases. But, UBS did note Macquarie was confident of a stronger FY24 second half.

The broker said a higher inflation, bond yield and interest rate backdrop was "clearly presenting challenges for alternative assets managers, from the deployment of capital, economic viability of projects and asset realisations."

The investment bank has reportedly been reducing its headcount, which may help.

UBS forecasts that Macquarie may generate earnings per share (EPS) of $7.92 in FY24 and $9.23 in FY25. That would imply the current Macquarie share price is valued at 21x FY24's estimated earnings and 18x FY25's estimated earnings.