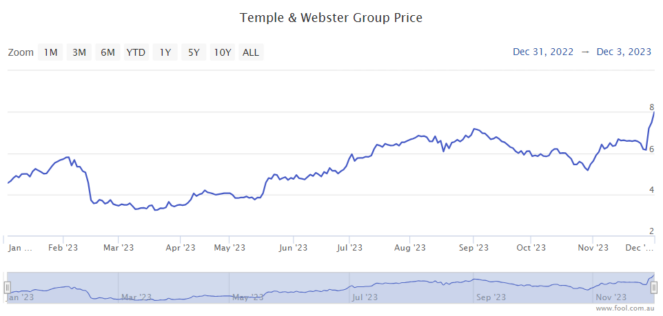

The Temple & Webster Group Ltd (ASX: TPW) share price has had an incredibly strong year. The All Ordinaries Index (ASX: XAO) share is up 75% in 2023 so far, and I think the long-term looks positive. So let's take a closer look at the All Ords ASX share.

Now, I can't say where the Temple & Webster share price is heading over the next month or next year, but I'm very optimistic about the long term.

There are a number of things that can lead to a company's long-term success. But, there are two elements that I really want to see from an ASX growth share: revenue growth and profit margin growth. And Temple & Webster ticks both of them.

Revenue growth

Revenue growth is crucial because it means the business is growing operationally, it can achieve scale benefits, and there's a strong tailwind for potential profit growth even if margins don't change.

Indeed, the company has suggested that as it becomes bigger, its marketing budget can increase, it can better predict sales for private labels and partners (and meet minimum order quantity thresholds), and invest more in people and technology. It'll help with its fixed cost-to-sales ratio, and be able to invest in new growth areas (such as home improvement).

Temple & Webster recently gave its annual general meeting (AGM) trading update, which showed sales growth of 23% for the period of 1 July to 27 November and sales growth of 42% year over year for the period of 1 October to 27 November. The Black Friday to Cyber Monday trading period saw sales growth of 101% to $17.4 million.

The ASX All Ords share is growing market share at a time when Australia's overall furniture and homewares market is seeing declines.

It aims to become the largest retailer of furniture and homewares in Australia. For now, it's targeting $1 billion of annual sales in three to five years – it made $396 million of revenue in FY23.

Profit margin improvements

Temple & Webster is expecting margins to significantly increase.

In FY23, the ASX All Ords share saw a 'business as usual' earnings before interest, tax, depreciation and amortisation (EBITDA) margin of 3.7%. This is expected to grow to at least 15% in the long term.

In FY26, the retail company plans to start "incrementally building" towards its long-term target. In the shorter term, it's targeting high growth and market share gains. AI usage is one of the things that could help with its customer service staff costs as well as its fixed costs.

As the company becomes larger, the higher margins could enable significantly stronger net profit after tax (NPAT), in my opinion.

Temple & Webster has a fairly capital-light model, so it can produce very pleasing amounts of cash flow and profit as it grows.

By the end of the decade, I believe Temple & Webster can materially generate more than $1 billion of annual sales and produce increasingly impressive margins. I think the ASX All Ords share could significantly outperform the All Ordinaries over the next five to seven years.