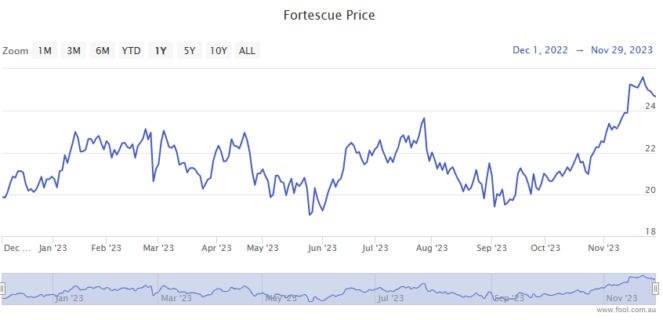

The Fortescue Metals Group Ltd (ASX: FMG) share price just capped off a banner month.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining stock closed out October trading for $22.30. When yesterday's closing bell announced the end of November's trading, shares were swapping hands for $24.99 apiece.

That sees the Fortescue share price gain a very impressive 12.1% in November.

For some context, the ASX 200 finished the month up 4.5%.

Here's what spurred interest.

What boosted the Fortescue share price in November?

The Fortescue share price received some heady tailwinds on several fronts over the month gone by.

First, a big uptick in the prices for its primary revenue-earning metals.

Iron ore, Fortescue's biggest revenue earner, kicked off November trading for US$122 per tonne. The steel-making metal reached US$138 per tonne on 22 November and ended the month at US$133 per tonne.

Copper also saw a big lift over the month. On 1 November copper was trading for US$8,111 per tonne. Copper ended the month at US$8,465 per tonne.

Both metals received a boost from expectations of ongoing and increased stimulus measures out of China to boost the nation's sluggish economy. Particularly China's steel and copper-hungry property markets.

Those rising commodity prices bode well for the outlook of profits and upcoming dividends and saw investors bid up the Fortescue share price.

What else drew ASX 200 investor interest?

Rising copper and iron ore prices explain some of the strong performance in the Fortescue share price in November. But not all of it.

The BHP Group Ltd (ASX: BHP) share price, for example, gained a more modest 4% in November. While the Rio Tinto Ltd (ASX: RIO) share price finished the month up 6.3%.

Fortescue's outperformance looks to be driven by investor optimism over the company's green energy ambitions. While there's no shortage of risk involved in this venture, and the costs are mounting, the potential longer-term payoff could make all that well worthwhile.

Fortescue made several announcements on the renewable energy front last month.

The biggest news came on 21 November. That's when the ASX 200 miner announced its plans to invest US$750 million (AU$1.1 billion) on two green hydrogen projects and one green metals project over the next three years.

The board reported it had approved a Final Investment Decision (FID) on Fortescue's Phoenix Hydrogen Hub, in the United States; its Gladstone PEM50 Project, in Queensland; and its Green Iron Trial Commercial Plant, in Western Australia.

The Fortescue share price closed up 0.7% on the day, hitting a new 52-week high.