The Fortescue Metals Group Ltd (ASX: FMG) share price is marching higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) iron ore miner closed yesterday trading for $25.30. During the lunch hour on Tuesday, shares are swapping hands for $25.74, up 1.7%.

For some context, the ASX 200 is up 0.1% at this same time.

The Fortescue share price is notching a fresh 52-week high today, enjoying tailwinds on several fronts.

First, the iron ore price gained again overnight to reach US$130.70 per tonne.

Investors also appear enthusiastic over the miner's major green project expansion plans, announced this morning.

Here's what's happening.

ASX 200 mining stock going green

The Fortescue share price is in the, erm, green following the company's report that it intends to invest US$750 million (AU$1.1 billion) on two green hydrogen projects and one green metals project over the next three years.

Green hydrogen is produced by splitting the oxygen from hydrogen in water molecules using sustainable energy sources, like solar, wind or thermal.

This morning the board said it had approved a Final Investment Decision (FID) on its Phoenix Hydrogen Hub, located in the United States; its Gladstone PEM50 Project, located in Queensland; and its Green Iron Trial Commercial Plant, located in Western Australia (WA).

The board said the three projects' diversity are intended to prove green hydrogen commercial scale production in the US, electrolyser capacity and performance in Queensland, and new pure green ironmaking in Western Australia.

Commenting on the news that looks to be helping boost the Fortescue share price today, Fortescue Energy CEO Mark Hutchinson said:

The Phoenix Hydrogen Hub establishes Fortescue in one of the most attractive energy markets in the world, facilitated by the Inflation Reduction Act.

On the Queensland project, Hutchinson said, "The Gladstone PEM50 Project in Queensland will produce hydrogen at an industrial scale, allowing us to demonstrate the high quality of Fortescue's own hydrogen systems."

Fortescue Metals CEO Dino Otranto added:

Fortescue is taking a proactive approach to green iron, including embracing innovative technologies that will help us step away from the use of fossil fuels.

FY 2024 guidance update

The ASX 200 miner also updated its FY 2024 guidance, with the Fortescue Energy capital expenditure guidance increasing to US$500 million, up from the prior US$400 million. An increase doesn't look to be dampening the Fortescue share price performance today.

The company said the increase reflects "the incremental investment in Phoenix Hydrogen Hub and the Gladstone PEM50 Project".

Fortescue Metals FY 2024 capital expenditure remained unchanged at US$2.8 billion to US$3.2 billion.

Fortescue share price snapshot

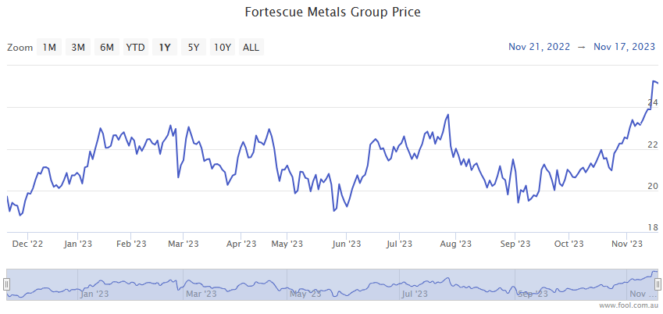

The Fortescue share price has been a strong performer over the past year, up 34%.