As the market prepares for a Christmas rally, one expert has spelled out the four ASX shares that she thinks have the best chance of taking advantage.

Here are the four stocks that Moomoo market strategist Jessica Amir says are "winners" right now:

2 ASX stocks to buy now

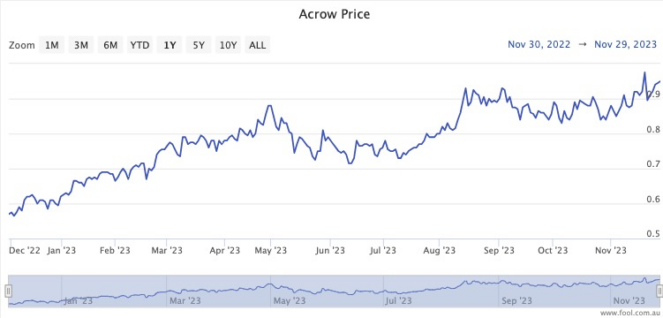

Not much is heard about Acrow Ltd (ASX: ACF) but Amir's team is "feeling bullish" on the stock.

"This Australian business operates in industrial construction," Amir said.

"With plenty of forward contracts and government contracts secured, they're a growing business. Plus, they have a strong monopoly in the high-rise scaffolding sector."

Calling it a "hot stock", Amir noted how the share price has rocketed 54% so far this year.

"They've also recently made moves to purchase Mackay-based MI Scaffolding — strong signs of growth and executive management."

Afterpay parent company Block Inc CDI (ASX: SQ2) is more than just a buy now, pay later services provider.

"Block is the company behind Afterpay, Cash App and the Square payment terminal — a diversified company that generates its revenue through a range of high-performing retail companies."

Therefore Amir tips that Block Inc's fortunes are surprisingly decoupled from consumer discretionary sentiment, which is low at the moment.

"With a major part of its profit coming from Square transactions and Bitcoin transfers, Block is resilient to retail movements and will likely continue reaping huge potential growth in the coming years."

And 2 to buy when the price is right

REA Group Ltd (ASX: REA) has been a darling of the Australian market for the last two decades, and has doubled its share price over the past five years.

"The owner of realestate.com.au, REA reaps 75% of its profits from property ads and has a strong stake in the online real estate platform market," said Amir.

She added that the stock surge has momentum, and the operations are expanding successfully in the Indian market.

"It's looking up for the business."

Although REA is "likely to be a winner" in the long run, Amir urged investors to look for the right entry point.

"It's worth considering selling your profits now and picking it up once the market value pulls back following the Christmas lull."

It's the same story with Xero Limited (ASX: XRO), which Amir called "a long-time favourite".

"Despite the recent pullback on profits, Xero has huge potential to globally expand and reach a new market," she said.

"For those interested in investing, consider purchasing once the stock dips back down."