If you were told of an ASX stock that has rocketed 30% this year while paying out 7.1% dividend yield, the first thought you have might be 'Can I get in on that action?'.

The team at Fairmont Equities correctly tipped McMillan Shakespeare Ltd (ASX: MMS) shares as a buy earlier this year when it was much cheaper.

But now that it's risen, Fairmont boss Michael Gable this week revisited the merits of the stock to see whether it's still worth diving in now.

A beneficiary of electric vehicle adoption

McMillan Shakespeare provides salary packaging and novated vehicle leasing services, as well as asset management and NDIS plan management.

According to Gable, the Group Remuneration Services (GRS) arm, which deals with the salary packaging and novated leasing, is "the main earnings driver".

And that unit has received a massive boost from the government's Electric Car Discount Policy, which provides fringe benefits tax exemptions for employers giving out benefits related to electric cars.

"In the 12 months since the introduction of the policy, the portion of McMillan Shakespeare's novated lease orders related to EVs has increased rapidly, to 36%," Gable said on the Fairmont Equities blog.

With electric vehicle adoption still in its infancy in Australia, Gable is expecting "further growth" in novated leasing volumes.

"In particular, EV availability in Australia remains limited, with only ~37 passenger and SUV models available. Further, it is estimated that ~85% of EVs sold have been below the Luxury Car Tax (LCT) threshold."

The balance sheet also looks healthy.

"McMillan Shakespeare has balance sheet capacity that could support capital management and/or acquisitions," said Gable.

"As at 30 June 2023, gearing — on a net debt to EBITDA basis — was 1.1x. This level is well below its recent peak of 2.5x as at 31 December 2019."

Recent stock price rise a preview of what's to come

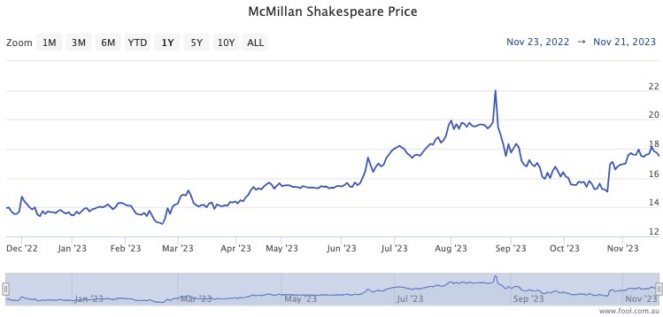

McMillan Shakespeare's price-to-earnings (P/E) ratio has rocketed from 13.5 to 14.5 since Fairmont Equities flagged it as a buy a few weeks back.

After all, the share price has spiked up 13.9% since 23 October.

Gable, however, still considers it a buy.

"We still believe there is value in the shares, especially in light of potential upside risk to medium-term EPS growth forecasts from a stronger-than-expected take-up of EVs and EPS-accretive acquisitions."

The stock's rise since late last month has given the "sustainable" momentum.

"This price action is very positive and it implies that a low is in place for now and that McMillan Shakespeare should continue to trend higher."

And of course, don't forget the 7.1% dividend yield, which is fully franked.