It seems ASX shares don't quite yet know whether to rally or plunge heading into Christmas.

That's why these developments, as picked by eToro market analyst Josh Gilbert, are worth monitoring this week:

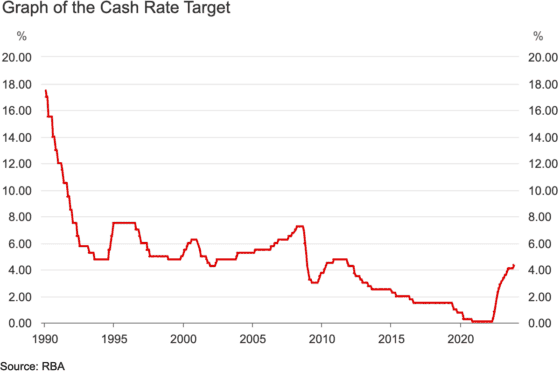

1. RBA governor speech and board minutes

The Reserve Bank of Australia's board minutes will be released on Tuesday, with governor Michele Bullock scheduled to speak at the ASIC Annual Forum on the same day.

The board minutes will provide insight into why the central bank raised interest rates this month.

"The bigger picture sentiment will tell us what we already know," said Gilbert.

"While other central banks increasingly head towards a softer tone, Australia is far from out of the woods – and the RBA's hawkish bias will likely stay intact for now."

Meanwhile, Bullock's speech will be keenly combed for "any hints of dovish sentiment", he added.

"It's highly unlikely they will get that, though, with this week's unemployment and wage figures causing further headaches for Bullock and the board heading into the year's end."

Retail numbers are due out towards the end of the month, and Gilbert feels like investors hoping for a cooling economy are about to be disappointed.

"A December rate pause will not signal the hike cycle is over, especially once retail figures drop in January following both the Christmas and Black Friday flurry."

2. Mining AGMs

The resources sector is a dominant player on the ASX, and many of its big names will host annual general meetings this week.

Gilbert reckons ASX lithium producers Pilbara Minerals Ltd (ASX: PLS) and Core Lithium Ltd (ASX: CXO) are worth keeping an eye on.

"Both stocks have had a miserable 12 months as lithium prices continue to freefall.

"Worse still, Core Lithium has seen shares plummet by 75% in that time, so this is a key AGM to reassure investors of what's ahead."

As a contrast, gold miners Bellevue Gold Ltd (ASX: BGL) and Evolution Mining Ltd (ASX: EVN) have each gained more than 40% over the past 12 months.

"Geopolitical tensions cause uncertainty across global markets, and central banks buy gold at record levels."

Gilbert noted the success or failure of AGMs can trigger upward or downward share price momentum.

"It's a great time for investors to get a sense of if the business is delivering and what's ahead," he said.

"With lithium's slump largely driven by slow demand against a glut of supply, material investors will be hoping for strong indications of increased lithium demand in the tech and hardware sector going into 2024."

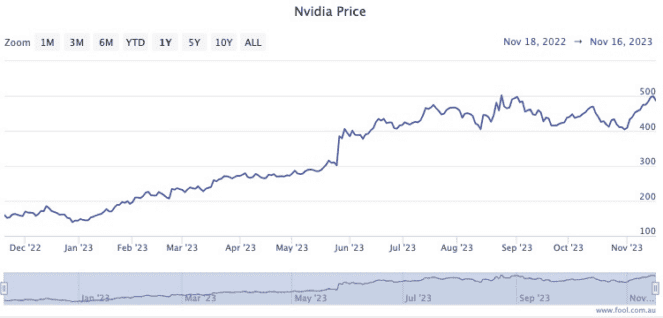

3. Nvidia earnings

The company behind arguably the hottest stock of 2023, NVIDIA Corp (NASDAQ: NVDA), will announce its third quarter results on Wednesday morning Australian time.

According to Gilbert, the market is amped for a likely "impressive set of earnings".

"Nvidia more than delivered in Q2 with eye-watering results, along with a solid forecast for the upcoming quarter, guiding for revenue of US$16 billion, well above estimates of US$12.6 billion."

All of the technology giants are hard at work developing their artificial intelligence technologies, but that shouldn't worry Nvidia yet.

"Nvidia is still leading the pack when it comes to converting hype into profit.

"Earnings are expected to rise by just under 500% this week, putting AI monetisation front and centre."

Nvidia shares have rocketed a crazy 245% so far this year.

"Recently, shares experienced a 10-day winning streak in November, following a dip in October," said Gilbert.

"The good news for AI investors broadly is that demand is set to stay high, with use cases exploding and businesses continuing to spend big."