If you've been trawling through ASX lithium shares, you may have noticed that Core Lithium Ltd (ASX: CXO) shares are among the worst-performing over the past year.

Unlike the prior three years of sensational returns, the Northern Territory lithium company has had its share price slashed by 75% over a one-year window. Still, long-term shareholders are up nearly eightfold in five years — potentially life-changing returns for those 'diamond handers'. However, it's a different story for investors who have joined the party more recently.

In the midst of soured sentiment, could it now be a rare opportunity to buy Core Lithium shares? Let's unravel the reason why this $822 million company is in the doldrums to understand better whether or not Mr Market might be letting their irrational tendency show here.

Why the fall?

Before investing in any company, it can be immeasurably helpful to grasp the prevailing story being told and accepted among investors.

I believe it is often ill-fated to be contrarian merely for contrarian's sake. Instead, it is far more productive to understand the commonly held view. Then, one can pick it apart to establish if it's a sound argument or riddled with flaws.

That being said, Core Lithium shares are among the most shorted on the ASX, claiming fourth spot this week. At a 10.5% short interest, plenty of short sellers are convinced the Core Lithium share price is overvalued — but why?

Core Lithium is a company selling a commodity. When selling a commodity (beef, wool, grain, iron ore, etc), your revenue and profits heavily depend on the price of the underlying commodity.

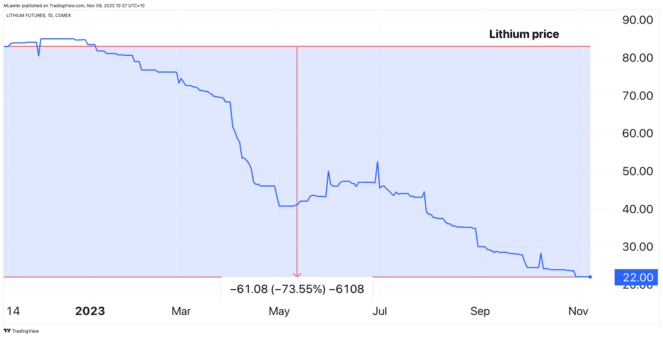

Unfortunately for Core and its shareholders, the price of lithium has sharply fallen during the past year. As shown in the chart above, lithium futures are down 73.5% compared to a year ago, dialling down the profit potential of ASX lithium shares.

Arguably, much of the slump in the lithium price stems from subdued electric vehicle (EV) sales amid a tightening global economy. In 2022, the International Energy Agency found that 60% of all lithium demand was derived from EV batteries.

So, understanding the sell side, what's the case for buying Core Lithium shares now?

Is now the right time to buy Core Lithium shares?

Firstly, we're operating in a speculative corner of the market here with multiple variables for Core Lithium to succeed in the years ahead.

At the first level, one must believe demand for lithium will continue into the future. Secondly, the price of lithium needs to be sustainably above Core Lithium's cost to mine with some margin over the long term. Thirdly, the company must deliver on growing its spodumene concentrate production and shipments.

Assuming all of the above criteria can be met, then it comes down to the fundamental analysis.

At present, the consensus among analysts is the lithium miner could deliver $92.87 million in net profits after tax (NPAT) in FY24. For context, the company generated $10.81 million in NPAT in FY23.

If achieved, it would mean Core Lithium shares trade on a forward price-to-earnings (P/E) ratio of roughly 9 times — cheaper than both Pilbara Minerals Ltd (ASX: PLS) and Mineral Resources Ltd (ASX: MIN) on FY24 earnings estimates.

However, I personally will be holding off on buying into Core Lithium for three reasons:

- Lower lithium grade mine than competitors

- Other ASX lithium shares with better unit costs (low-cost advantage)

- Relatively small total mineral resource size (31.1 million tonnes at Finniss) compared to others

For now, I'm more confident in buying shares in established players with clear competitive advantages.

For example, Albermarle Corporation (NYSE: ALB) is a low-cost operator with investments in some of the highest-quality lithium deposits in the world. The lithium behemoth currently trades on a 7 times FY24 forward earnings multiple, even lower than Core Lithium shares.