Financial expert and buy-and-hold advocate Brian Feroldi recalls the day in 1994 when NeXT chief executive Steve Jobs walked into the staff cafeteria.

"Who is the most powerful person in the world?" asked the Apple Inc (NASDAQ: AAPL) co-founder.

A few names like Bill Clinton, Nelson Mandela and Alan Greenspan popped up from his employees.

Jobs disagreed.

"The most powerful person in the world is the storyteller," he said.

"The storyteller sets the vision, values, and agenda of an entire generation that is to come."

Feroldi, in a newsletter to his subscribers, very much concurred with Jobs.

"Stories are the most powerful tool humans have ever created."

And the idea is applicable in stock investing too.

During investment research, when financial data is turned into an investment thesis, that is the act of turning raw facts into a story.

"If a company's revenue, gross margin, returns on capital, and free cash flow are all rising, we can infer that demand is strong, pricing power exists, and future growth will create shareholder value.

"That's a compelling thesis."

Image source: Getty Images

How a great story can wipe 97% off your investment

But compelling stories can also be extremely dangerous in investing.

"When our investment research starts and ends with a story — and we don't back it up with supporting data — we open ourselves up to huge losses."

The past few years have seen especially painful examples of this.

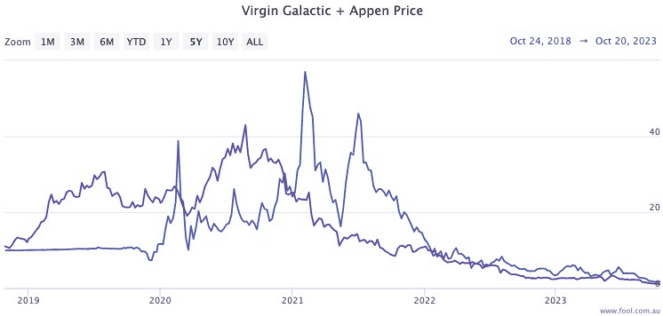

American stocks like space tourism provider Virgin Galactic Holdings Inc (NYSE: SPCE) and local shares such as Appen Ltd (ASX: APX) had fantastically alluring stories, and investors threw money at them like there's no tomorrow back in 2019 and 2020.

Then inflation and higher interest rates whacked sense into markets.

Virgin Galactic shares have now sunk 97% over the last two years. Appen has plunged the same amount over the past three years.

"These companies came public with great stories but little supporting financial data," said Feroldi.

"When the narrative surrounding these stories shifted, valuations imploded, and their investors lost a bundle."

Feroldi has admitted he and his team have also been burnt from falling in love with stories many times in the past.

"Some companies' stories sound so compelling that they have caused us to overlook glaring red flags."

How to protect yourself from seductive stories

Feroldi and his team now have a mechanism to save themselves from being seduced by a narrative or a charismatic CEO.

They have an "investing checklist" that they go through for each stock they consider buying.

"While checklists don't eliminate bad decisions entirely, they force us to focus on the data, question our assumptions, and check for red flags.

"This helps us combat our natural desire to invest based solely on a story."

He acknowledges stories appeal to basic human nature, so the effect is inescapable.

But a tick list at least provides some balance.

"Checklists help us to identify what the stories are and see if there is enough supporting data to back them up," said Feroldi.

"We encourage you to do the same with your portfolio. Create a checklist. Run your investments through it. Question your assumptions."

This method — and indeed nothing — can save you from all bad investments. But perhaps it will assist in reducing the number of Virgin Galactics and Appens in your portfolio.

"We can promise that creating a checklist and running any investment ideas through it will make you a much better investor."