The weather is heating up and many experts are tipping the stock market will put a terrible October behind it and rally for Christmas.

But just because the market heads up doesn't mean that all ASX shares will. You still need to be selective about which stocks to buy.

The experts at Morgans had a couple of ideas:

Aussies are about to go on summer holidays

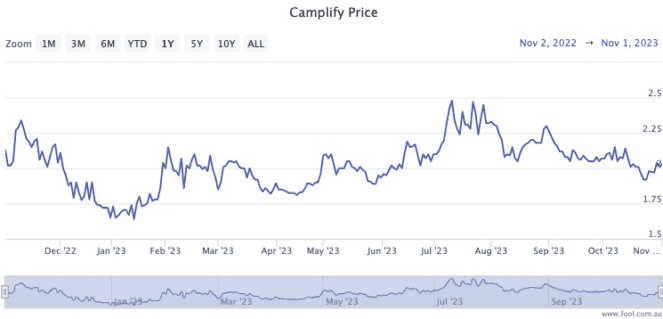

Morgans associate analyst Steven Sassine liked what he saw out of small-cap caravan-sharing platform Camplify Holdings Ltd (ASX: CHL) this week.

"Camplify released its 1Q24 trading update which continued to show the underlying business momentum in what is traditionally a seasonally subdued quarter," Sassine said on the Morgans blog.

"In our view, futures bookings growth also augurs well for a strong summer trading period in the southern hemisphere."

Group gross transaction volume of $41.5 million was a phenomenal 107% rise from a year prior.

"Revenue for 1Q24 was $11.7 million, [up] ~114% on pcp, implying a group global take-rate of 28.2% (vs 27.2% in the pcp)."

Sassine and his team aren't the only ones bullish on Camplify.

According to CMC Markets, both Canaccord Genuity and the Ord Minnett analysts also rate the stock as a strong buy.

Aussies are seeking a cheaper meal than steak

Sassine's colleague, senior analyst Belinda Moore, took a look at the trading update from Inghams Group Ltd (ASX: ING).

"Inghams provided 1H24 guidance which was materially better than expected," Moore said on the Morgans blog.

"Pleasingly, the strong 2H23 recovery in operational performance, which underpinned a positive start to FY24, has continued through into the 1H24."

While Morgans already had Inghams as a buy, the latest numbers convinced the analysts to push up the share price target 18% to $4.45.

That's a 14% premium on the stock price on Thursday afternoon.

"Ingham's valuation remains undemanding, with it trading on an FY24F PE of 10.8x and an attractive dividend yield of 5.6% fully franked."

Shaw and Partners portfolio manager James Gerrish also expressed his support for the chicken producer heading into the holiday season.

"History tells us that during tough economic times… we turn to the cheaper protein alternative of chicken over, say, steak. i.e. A likely tailwind through 2024."