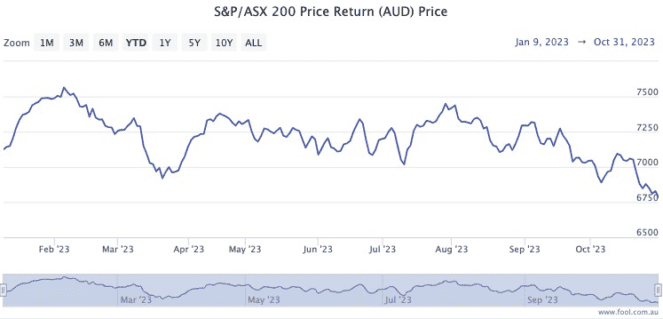

Unfortunately the last few days have seen both the S&P/ASX 200 Index (ASX: XJO) and S&P 500 Index (SP: .INX) plunge into a correction.

The ASX 200 is now 10% down from its February peak, while last Friday the S&P 500 had dipped that much in less than three months.

In fact, the ASX 200 just completed its worst October since 2018.

It's human nature to be demoralised from such a rapid deterioration of your stock portfolio.

So naturally our curiosity turns to what might happen to share markets over the last few weeks of 2023.

DeVere Group chief executive Nigel Green had some thoughts:

Share market rally for Santa

In short, Green reckons it's time to buy some bargains.

"We expect a rally for the end of 2023," he said.

"You should consider revising your investment mix to seize the potential opportunities in what we think will be a new phase."

Traditionally the end of the year is rally time for shares, according to Green.

"History shows that November is the second-best month of the year for markets, behind April.

"This November could be even more positive as some markets are currently in correction territory – falling by more than 10% — and so a swing to the upside will be more pronounced."

History shows how long corrections typically last

The other statistic pointing to a positive outlook comes from looking at how markets have recovered from past corrections.

"Over 72 years there have been 34 market declines. Only 12 of these have turned into bear markets," said Green.

"When does a recovery typically happen? 96 days after the start of the correction. We're now around day 90."

Another confidence booster is that Green reckons the US Federal Reserve will leave interest rates on hold at its meeting this week.

That would make it bullish for US stocks, but also for ASX shares as the Reserve Bank of Australia can't afford to diverge too much from what the Americans do.

The shares to buy right now

If all these conditions come to fruition, punters will want to buy shares now while they're still cheap.

"If all this data holds up, we're about to see a year-end rally, which investors would not want to miss out on."

While Green emphasises diversification as the first priority, there are some specific industries that look attractive at the moment.

"Sectors that could appeal to investors as markets recover include tech and renewable energy. These sectors have demonstrated resilience and potential for growth even during market downturns.

"Additionally, consider allocating funds to undervalued industries that may benefit from economic rebounds, such as travel and leisure, as pent-up consumer demand surges."