A household S&P/ASX 200 Index (ASX: XJO) name made a huge move earlier this week that has the pundits polarised.

Penfolds maker Treasury Wine Estates Ltd (ASX: TWE) put its shares in a trading halt on Tuesday morning so that it could launch an equity raising to fund an acquisition.

It needs to come up with up to US$1 billion ($1.6 billion) to take over Californian winemaker Daou Vineyards.

'Why do you need to keep doubling down in the US?'

The move immediately faced critics, with Bank of America Corp (NYSE: BAC) analyst David Errington reportedly questioning the deal over the phone moments after the announcement.

"I just don't get why you need to keep doubling down in the US," Errington said, as first reported in the Australian Financial Review.

"I just don't get why you wouldn't buy back your own stock and leverage up Penfolds."

Shaw and Partners portfolio manager James Gerrish admits the renewed push into the US is gutsy.

"This is a reasonably bold play by CEO Tim Ford, considering its chequered history in the US," he said in his Market Matters newsletter.

"We admire his belief and, unlike many, the confidence to take the hard/bold calls. Let's hope he's right!"

Luxury market is the name of the game

Gerrish's team likes that Daou Vineyards reinforces Treasury's recent focus on the luxury — read high margin — end of the wine market.

"In the US last year, Treasury Wine volumes fell by 25%, but earnings improved by 14%. Ford is clearly hoping for more of the same."

The merger provides about $20 million in cost synergies for the two sides.

"The purchase will make Treasury Wine a market leader in the US luxury wine market with over 11% market share."

While critics have raised how poorly Treasury's past ventures in the US market have been, Ford has been urging investors to judge the record over the past three years that he's been in charge.

"Ford can point to the recent success story in the 2021 acquisition of Frank Family Vineyards. This business accounted for 20% of Treasury's US earnings in 2023."

Go 'long and bullish' on this growth stock

For the record, Gerrish's team would also have preferred Treasury return capital to investors via a share buyback.

But it remains "long and bullish" on the growth stock with the Daou deal and tailwinds it already knew were coming.

"Over recent weeks, the bull case for Treasury has been around the removal of China's tariffs on Australian wines, which now seems likely, and Penfold's growth can recommence in earnest."

Gerrish's team and investors now eagerly await the details for the coming capital raising to fund the Daou acquisition.

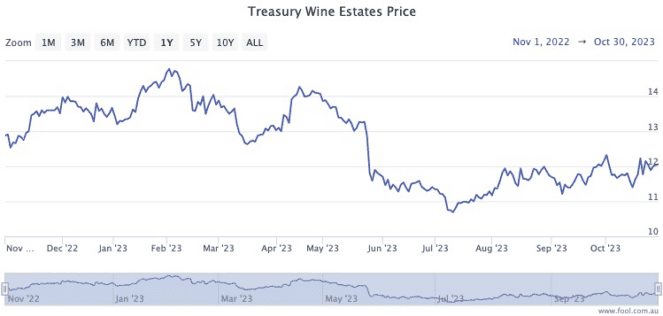

The Treasury Wine share price is down 7.5% so far this year, but has climbed more than 14% since 10 July.