Gold, for centuries, has maintained a reputation as a safe haven investment.

The idea is that even when high-growth markets like shares and real estate are gripped by fear, gold will hold its value because of its practical and aesthetic utility.

Gold was also formerly used as the commodity that backed many Western currencies, which reinforced its value in those societies.

So if you were to buy gold shares right now, which one might be the pick of the bunch?

Fairmont Equities managing director Michael Gable had an idea this week:

These gold shares will cash in from price rises

Firstly, Gable is bullish on gold prices from here onwards.

"Despite the war in the Middle East, we expect gold prices to move higher anyway due to falling bond yields and a weaker US dollar."

And among the ASX 200, he knows which gold stock he would buy.

"Evolution Mining Ltd (ASX: EVN) remains our preferred stock in the gold sector to benefit from any rises in the gold price," Gable told The Bull.

"The company recently sustained fiscal year 2024 guidance of 770,000 ounces at an all-in sustaining cost of $1,370 an ounce."

The Evolution share price has already rocketed more than 76% over the past year.

The Motley Fool's Bernd Struben is also a fan of Evolution Mining for its potential future margins.

"I believe gold's safe haven asset could well see it break back above US$2,000 per ounce and beyond in the months ahead."

But so can this stock

Mind you, the stock is somewhat divisive among the professional community.

According to CMC Markets, five out of 18 analysts rate Evolution Mining as a strong buy. But six others think it's a sell.

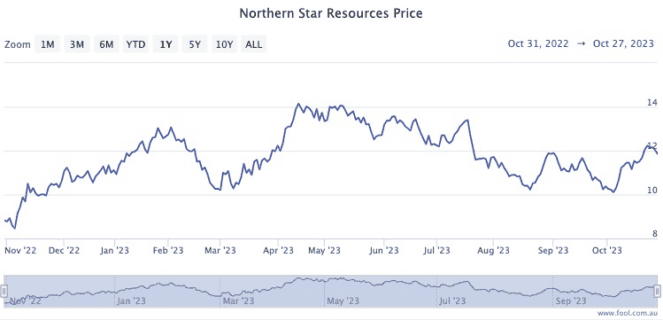

A less controversial pick might be Northern Star Resources Ltd (ASX: NST), which was Struben's other recommendation.

Its share price hasn't run up quite as hard, gaining 39.8% over the last 12 months. Perhaps this gives it a tad more upside.

Northern Star is rated a buy by nine out of 16 analysts surveyed on CMC Markets, with none recommending a sell.