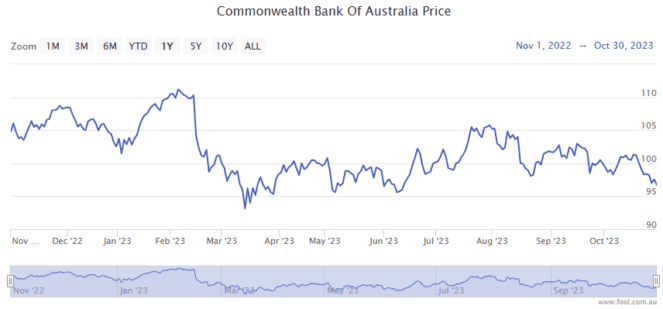

The Commonwealth Bank of Australia (ASX: CBA) share price has struggled to find traction in 2023.

Just about flat in intraday trading on Wednesday at $96.58 apiece, shares in the S&P/ASX 200 Index (ASX: XJO) bank stock are down 4.6% year to date.

That compares to a 2% loss posted by the ASX 200 over this same period.

And with fierce competition continuing in Australia's lucrative mortgage market, the CBA share price could face more headwinds.

What's happening in the Aussie mortgage markets?

According to data from the Australian Prudential Regulation Authority (APRA), September marked the third straight month that CBA saw its market share of the Aussie mortgage market slip.

"CBA witnessed another month of contraction in mortgages, albeit slowing, with mortgages down 0.1% month-on-month, driven by a 0.2% month-on-month contraction in owner-occupier," UBS analyst John Storey said (quoted by The Australian).

The CBA share price could face some particular pressure from rival lenders ANZ Group Holdings Ltd (ASX: ANZ) and Macquarie Group Ltd (ASX: MQG).

Storey noted that Macquarie saw its mortgage lending increase by 1.3% in September, while ANZ recorded month on month growth of 0.9%. The Macquarie share price is down 2.5% in 2023, while the ANZ share price has gained 7.7%.

"Macquarie are back in the game," Finspo CEO Angus Gilfillan said (quoted by The Australian Financial Review).

With competition for home loans squeezing profit margins, CBA rolled back some of its discounts and cash incentives earlier this year. While that may increase the bank's margins on new loans, it could prove to be a double-edged sword for the CBA share price.

According to Gilfillan:

All lenders want to be profitable and be growing market share. Three consecutive months going backwards would be starting to ring some alarm bells at CBA because home loans are a big momentum business…

CBA was most the competitive during pandemic but has almost turned full circle now. Has CBA moved the needle too far, and will there be a move back to be more competitive pricing, at a time many customers are coming off fixed rates and know they need to shop around?

But don't count Australia's biggest bank out just yet. As of the end of September CBA's mortgage market share still stood at an impressive 25.4%.

How has the CBA share price performed longer-term?

Atop the big bank's regular dividend payments, the CBA share price has gained 41% over five years.