There is no sugar-coating that the share market is struggling at the moment.

The S&P/ASX 200 Index (ASX: XJO) set a new 12-month low earlier this week as violence in Europe and the Middle East, rising bond yields, and stubborn inflation made investors nervous.

As such, many ASX shares have hit 52-week lows in recent times.

But one particular prominent stock sank to an embarrassing all-time low this week.

Amid the carnage, could this prove to be a bargain for the shrewd investor?

This stock has literally NEVER been cheaper

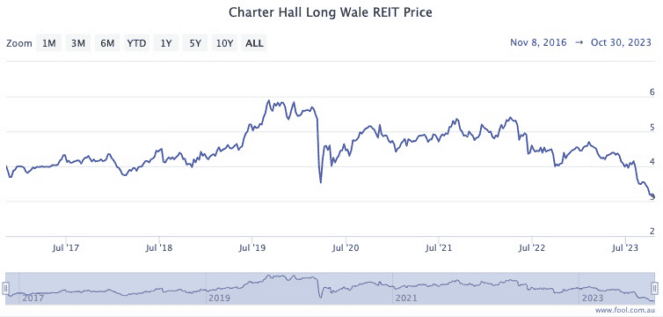

Charter Hall Long WALE REIT (ASX: CLW) debuted on the ASX in October 2016.

It started its listed life in the high $3s before rising to as much as $5.85 in the six months before COVID-19 struck the world.

With rising interest rates striking blows to the economy, Charter Hall Long WALE shares have been a disaster this year, losing more than 31% thus far.

On Monday, at the same time as when the ASX 200 was plunging to a year-long low, Charter Hall Long WALE sold for $2.98, which is the lowest price it has ever traded for.

Ouch.

The reason for the recent malaise seems to be a negative reception to its reporting season numbers.

"Operating earnings per security and distribution per security were both down by 8.2%," Catapult Wealth portfolio manager Tim Haselum said in September.

"We expect Charter Hall Long WALE to sell assets to reduce gearing."

What if you bought at the all-time low?

So what's the upside for Charter Hall Long WALE?

The drop in valuation means that any investor willing to dive in now will command an excellent dividend yield of 9.7%.

The other ace up the sleeve is that many experts reckon Australia is nearing the end of interest rate rises.

Perhaps there will be one more on Melbourne Cup Day, but the Reserve Bank will be very cautious after that to not plunge the nation into recession.

"Long WALE" means that this real estate investment trust (REIT) targets properties that can host tenants with long lease periods.

This provides stability of income for the trust and its shareholders.

Currently the average lease is 11.2 years, and Charter Hall Long WALE's assets enjoy a 98.6% occupancy rate.