One of the most useful things about an S&P/ASX 200 Index (ASX: XJO) share market decline is that not only are valuations better, but the potential passive income becomes more attractive for prospective investors.

For example, imagine a company pays a dividend yield of 5%. If the share price falls by 10%, then the yield on offer becomes 5.5%. A 20% decline becomes 6%. And so on.

Below are three ASX 200 passive income shares that could pay resilient dividends and distributions to investors in the short and longer term.

APA Group (ASX: APA)

The APA share price is down 33% since August 2022, as we can see in the chart below.

This company owns a large portfolio of energy assets, including a gas pipeline, gas storage, processing and energy generation, as well as renewable energy assets and transmission assets.

Energy is as important as ever, but the market now appears to value the ASX 200 share at a much lower level, even though its distribution continues to grow and it's increasing its exposure to non-gas assets.

In terms of the passive income in FY24, APA's distribution is expected to increase by another 1.8% to 56 cents per security. That translates into a distribution yield of 7%. The company has increased its distribution every year since 2004.

Centuria Industrial REIT (ASX: CIP)

The Centuria Industrial REIT share price has declined by 26% from April 2022, which we can see in the chart below.

This real estate investment trust (REIT) is purely focused on industrial properties, which are seeing strong demand and high occupancy rates, which is helping the ASX 200 share with rental growth and offsetting higher interest rates.

With a 7.7-year weighted average lease expiry (WALE), the business has long-term visibility of rental income.

The company guided that in FY24, it would generate net rent, or funds from operations (FFO), of 17 cents per security. This will enable the business to pay a guided distribution of 16 cents per unit, which would be a passive income yield of 5.4%.

Sonic Healthcare Ltd (ASX: SHL)

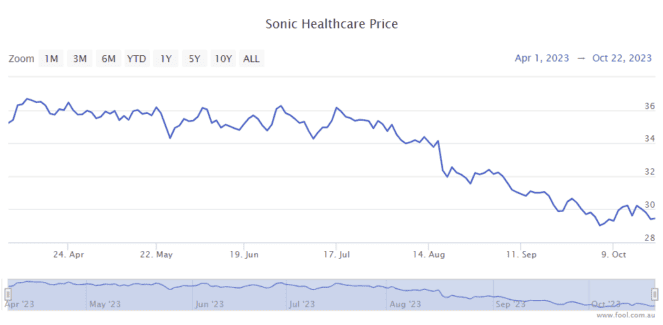

The ASX healthcare share sector has seen some pain recently, including the Sonic Healthcare share price, which has fallen around 20% in the last six months, as we can see on the chart below.

Sonic is a global pathology business with a major presence in countries like Australia, the United States and Germany. It has grown its dividend annually for most of the last 20 years. The board of directors has what they call a "progressive" dividend policy.

In FY23, the business increased its passive dividend income by 4% to $1.04 per share, which translates into a grossed-up dividend yield of 5%.