Owners of Insurance Austria Group Ltd (ASX: IAG) shares usually get a good dividend each year. With conditions looking up for the insurance giant, and the sector as a whole, could bigger passive income be on the way?

Positivity for the insurance sector

There are at least three things going well IAG shares.

First, inflation is helping drive the insurance premiums higher, which increases its overall gross written premiums (GWP) and can help drive the bottom line. If IAG is able to maintain its profit margin, then stronger revenue growth helps net profit, even if costs are rising at a fast rate too.

Second, the weather has reportedly changed from La Nina (wetter) to El Nino (drier). Storms are damaging for properties and people while being very costly for insurers. Less weather events could end up helping profitability a lot in the next couple of years.

Third, now that interest rates are much higher, insurers are able to earn much stronger returns on their bond portfolios.

In FY24, the business is expecting "low double-digit" gross written premium growth, with its reported insurance margin guidance for a range between 13.5% to 15.5%.

How big could IAG dividends be?

In FY23, the insurance giant paid an annual dividend per share of 15 cents, which represented an increase of 36% compared to the FY22 payout of 11 cents.

If we use the payout for the last 12 months, it's a partially franked dividend yield of 2.6%. That's certainly not exciting.

But the next two financial years could become much more rewarding for owners of IAG shares.

The projection on Commsec suggests that the IAG dividend could almost double to 26.5 cents per share. That would be a partially franked dividend yield of 4.6% if that prediction came true.

In FY25, the dividend could then rise by another 17% to 31 cents per share. That implies the dividend could more than double between FY23 to FY25. If it does pay 31 cents per share in FY25, it'd be a partially franked dividend yield of 5.35%.

Foolish takeaway

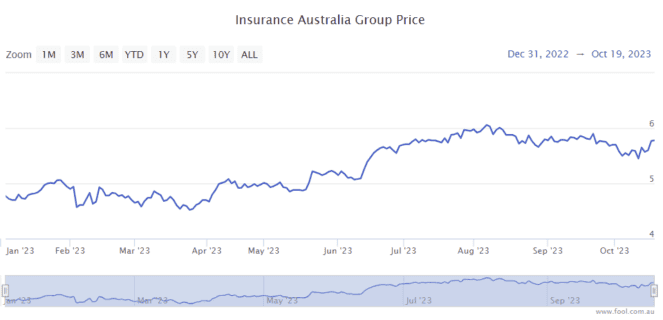

Things are really looking up for the insurer, so it's understandable why the IAG share price has gone up 24% since the start of 2023, as we can see on the chart below.

While the dividend is projected to jump from here, keep in mind a forecast is not a guarantee of future payments.