S&P/ASX 200 Index (ASX: XJO) shares, all told, remain in the green for 2023.

Despite sliding 1.5% in intraday trade today, the benchmark index is still up a slender 0.3% year to date. And that figure doesn't include the dividends many of these companies have paid out.

While a few ASX 200 shares have roughly doubled in value this year, others have gone decidedly the other way.

Below we look at the three worst performers (as of the opening bell on 3 January and excluding any dividends) and ponder whether now may be an opportune time to buy some shares.

The second and third worst performers of 2023

The third worst performer is Iress Ltd (ASX: IRE), which designs and develops software and services for the financial services industry. The Iress share price is down 42.3% year to date.

The ASX 200 share was in positive territory for the year, even paying a final dividend in February, right up until the company delivered its half-year results on 21 August. This saw the stock tank by 35.5% on the day after reporting a net loss after tax of $140 million, suspending its interim dividend, and downgrading its FY 2023 guidance.

Unfortunately, shares have continued their downward trend since then, dropping another 12.4% as of 22 August.

The low might be approaching following this savage sell-off.

Indeed, management said it expected the company's cost reduction program and a review of pricing to be recognised in FY 2024. Still, I'd steer clear of this tech stock until it begins to show signs of a sustained recovery.

Which brings us to the second worst-performing ASX 200 share of 2023, Cromwell Property Group (ASX: CMW).

Shares in the Australian real estate investment trust (REIT) and fund manager have crumbled 45.2% this calendar year to 37.2 cents per share. Cromwell has also paid out 3.6 cents in dividends.

Aside from the potential allure of that passive income – Cromwell shares trade on a trailing yield of 9.4% — buying this stock today could also still be akin to catching that falling knife.

With Cromwell shares remaining in a downtrend (down 12.8% over the past month), this may be one to keep on that rebound watchlist for now.

The worst-performing ASX 200 share to hold so far in 2023

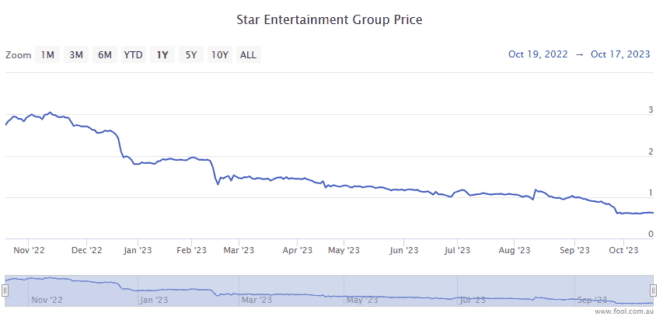

The ignominious honour of worst performing ASX 200 share goes to The Star Entertainment Group Ltd (ASX: SGR).

Shares in the casino owner and operator are down a precipitous 61.3% in 2023.

The company has been struggling for some time now, and this year brought new pain.

Among that, both New South Wales and Queensland launched inquiries, alleging Star was not living up to its obligations to prevent money laundering and mitigate problem gambling at its casinos. Star has since paid $100 million in fines.

The ASX 200 share also came under pressure when it announced a $750 million capital raising at 60 cents per share on 27 September, a massive discount to the share price the prior trading day. The Star Entertainment share price crashed 15.3% on the day.

A number of analysts came out with buy recommendations in September. And as of 6 October, CommSec has consensus analyst recommendations as a 'strong buy', with six analysts at a 'strong buy' and two at a 'moderate buy'.

However, with more potential interest rate hikes ahead and inflation yet to be tamed, I'm concerned that many Aussies will be spending their money on more pressing needs than gambling over the shorter term.

And with the ASX 200 share down 22.8% over the past month alone, this is another stock investors might be better off putting on their watchlist until it begins to demonstrate a sustainable turnaround.