When an ASX stock sinks, you can interpret the move in one of two ways.

The first is what you see is what you get. The business is declining and its growth or income prospects have been dented.

The second is that the business is actually fine and running the successful way it always has, but there's some sort of short-term event that's scaring investors.

In the latter case, investors with long-term horizons could pick up a bargain to patiently wait out the storm.

A pair of experts this week named two ASX shares that fit that bill right now:

These 'shares offer value'

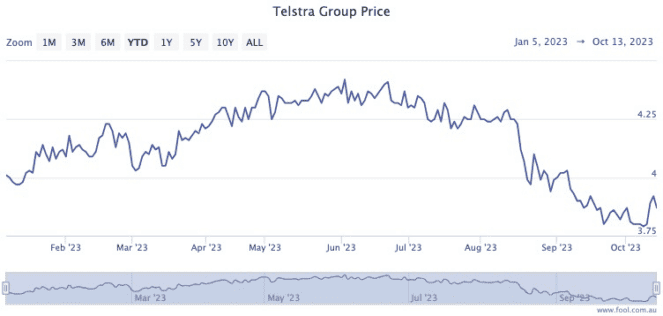

Telstra Group Ltd (ASX: TLS) started falling during reporting season to now trade 9.8% lower since 10 August.

Ord Minnett senior investment advisor Tony Paterno expressed no issue with the annual results, as the 10% rise in earnings before interest, taxes, depreciation, and amortisation (EBITDA) had met his team's expectations.

Rather, it was what the company decided not to do that frightened away some shareholders.

"The decision to retain ownership of the InfraCo Fixed unit wasn't well received by investors," Paterno told The Bull.

"We understand the appeal of monetising a percentage of InfraCo Fixed, but, in our view, there's no rush to separate a business inextricably tied to Telstra's mobile unit, as it could limit other potential partnerships in the future. Telstra shares offer value."

It seems most of Paterno's peers agree.

According to CMC Markets, 12 out of 14 analysts currently rate Telstra as a buy.

Any short-term volatility is also somewhat offset by a decent dividend yield of 4.4%, fully franked.

'One of the largest hard rock lithium deposits'

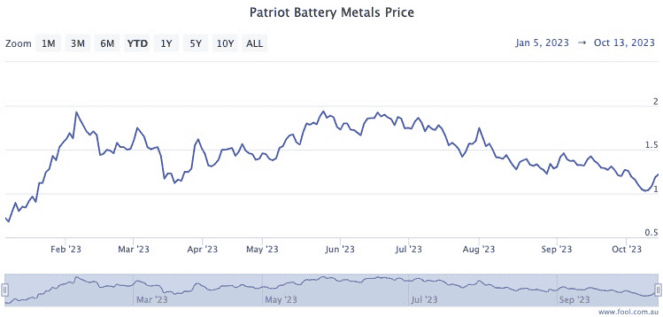

As the Chinese economy struggles, lithium prices have been on a slide since July.

This has meant miners like Patriot Battery Metals Inc CDI (ASX: PMT) have seen their stock price take a dive, too.

Indeed, Patriot shares have plunged 36% since 5 July.

BW Equities equities salesperson Tom Bleakley reckons that discounting is excessive.

"In our view, the shares have been oversold, as the company holds what we anticipate will become a strategic asset in the key North American market.

"It's focused on advancing its Corvette property in Canada."

The fact remains that Corvette has huge potential to serve a world that will be thirsty for lithium to make all the batteries it needs for items like electric cars.

"It has a maiden inferred mineral resource estimate of 109.2 million tonnes at 1.42% lithium oxide, making it one of the largest hard rock lithium deposits in North America."

The professional community likes this pick, too. All nine analysts that currently cover the stock are rating Patriot Battery Metals as a buy, as shown on CMC Markets. Eight of those reckon it's a strong buy.