ASX small-cap shares can be a great area of the share market to find little-known opportunities that could deliver strong long-term returns in the form of both dividends and capital growth.

Big businesses like Commonwealth Bank of Australia (ASX: CBA) and BHP Group Ltd (ASX: BHP) are great, but it could be hard for them to deliver a lot of growth due to their huge market capitalisations. They are already the biggest in their respective sectors on the ASX.

With that in mind, I think there are a number of smaller businesses that could deliver pleasing growth from here.

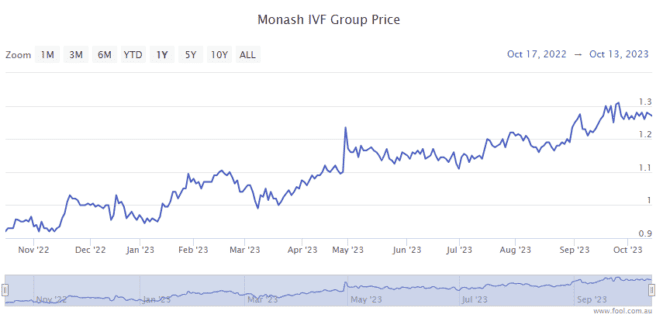

Monash IVF Group Ltd (ASX: MVF)

With 50 years of history, this company has delivered more than 50,000 babies through fertility treatments or assisted reproductive technologies (ART), including IVF.

Monash IVF has a very strong presence in Australia and a growing presence in Southeast Asia, including Malaysia, Singapore and Indonesia.

The company had a solid FY23, with revenue rising 11.1% to $213.6 million and underlying net profit after tax (NPAT) increasing 14.7% to $25.5 million. Monash saw a return to industry growth after COVID-19, while it also achieved market share gains, and there were good new patient registrations. The company said this provided a positive growth trajectory heading into FY24.

The ASX small-cap share is steadily making bolt-on acquisitions which are helping growth and market share. This includes ART Associates Queensland, which was completed in September 2022.

Ongoing solid conditions in the new patient registrations and the contribution from acquisitions could help earnings in FY24 and beyond.

According to Commsec, the company is valued at 18x FY24's estimated earnings and could pay a grossed-up dividend yield of 5.6%.

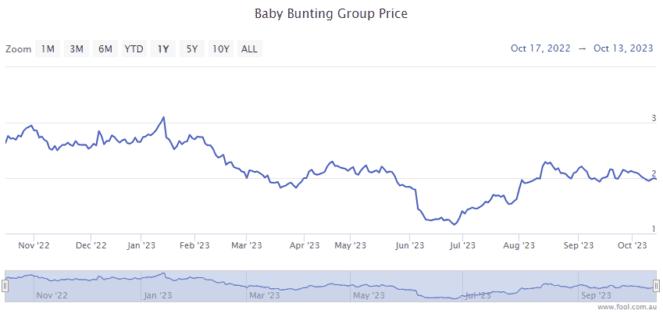

Baby Bunting Group Ltd (ASX: BBN)

Baby Bunting is a leading retailer of baby products in Australia, such as car seats, prams, toys and clothes.

Since April 2021, the Baby Bunting share price has fallen by almost 70%, so it's a lot cheaper now. It's understandable why investors have sent the ASX small-cap share down – sales and profitability have suffered compared to a couple of years ago.

FY23 saw comparable store sales decline by 3.6%, and NPAT sank 51% to $14.5 million. In a recent trading update, in FY24 to 8 October 2023, total sales were down 3.3%, and comparable store sales fell 8.5%.

However, there are a number of positives showing that could be a signal for good future profitability. In the FY24 first quarter, the gross profit percentage was 37.9%, an increase of 70 basis points, and the administration costs were reduced by $1.7 million year over year. The company also said that inventory levels had been "well-controlled".

It continues to open new stores, with one Victorian store opening at the end of the first quarter. It has plans to open a further four new stores (one in Australia and three in New Zealand).

I'm also excited by the company's potential to achieve growth through its 'marketplace' segment, which expands its range and enables it to generate earnings on categories like nursery furniture, outdoor play equipment and footwear.

It doesn't need to invest in inventory or infrastructure for this because the products are coming from brands and suppliers.

In FY25, the business is expected (according to the Commsec projection) to generate 18.6 cents of earnings per share (EPS), which would put it at 11x FY25's estimated earnings and deliver a grossed-up dividend yield of 8.5% in FY25.