A humanitarian tragedy is unfolding in the Middle East, with Australian hearts going out to innocent victims in both Israel and Gaza.

In the finance world, the horrible events have just added to pressures on the global energy market.

The world was already dealing with reduced supply of gas and oil due to Russia's invasion of Ukraine, plus deliberate curbs on crude production from Saudi Arabia and Russia.

Now with fierce fighting potentially destabilising a region known for producing oil, much of the world is suffering from unprecedented anxiety about energy security.

This all means that ASX energy shares representing old sources could become more valuable while we wait years for sufficient renewable generators to come online.

Old school energy shares could cash in

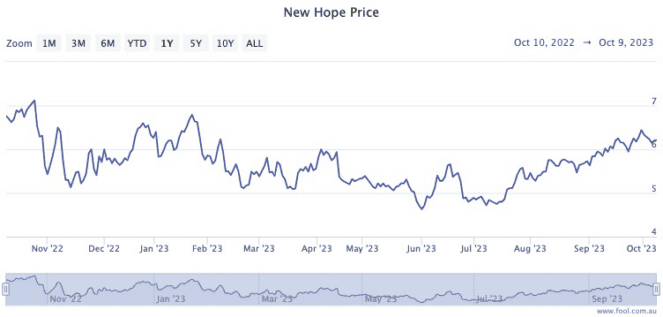

This is why Glenmore Asset Management's coal mining stock New Hope Corporation Ltd (ASX: NHC) could be a handy addition to portfolios.

Portfolio manager Robert Gregory, in a memo to clients, noted the energy shares rocketed 12.8% last month.

"During the month, NHC reported its FY23 result, where EBITDA of $1.75 billion and NPAT of $1.09 billion was reported."

The bumper numbers allowed New Hope to reach a stunning 11% dividend yield.

"The company declared a final dividend of 21 cents per share and a special dividend of 9 cents per share, taking FY23 total dividends to 70cps."

Gregory admitted the conditions weren't quite as favourable now compared to the 2023 financial year.

"The result was materially boosted by strong thermal coal prices (average selling price of $346/t) which is now well above current prices."

But perhaps this gives New Hope plenty of upside for those investors willing to dive in now.

"Whilst the recent fall in thermal coal prices will likely see lower earnings in the next few years vs FY23's result, given NHC's low cost of production and increased production profile, we believe the company is well positioned to generate very significant free cash flow."

Coal, but not energy

Stanmore Resources Ltd (ASX: SMR) is also a coal producer, but its stocks are not energy shares.

That's because the company makes coking coal, which is used to make steel.

Because it has such a distinct use to energy-producing thermal coal, coking coal trades with a completely different global price.

The Stanmore share price rose a phenomenal 27.6% during September.

"The stock was boosted by a strong rally in coking coal prices during the month (hard coking coal was up ~25%), despite subdued global steel markets," said Gregory.

"Also, the company was included in the S&P/ASX 300 (ASX: XKO) index in September."

Gregory is not the only one bullish on Stanmore Resources, which has gained an amazing 314% over the past five years.

According to CMC Markets, both Morgans and Ord Minnett count the stock as a strong buy.