There's nothing like backing a winner, right?

If you see ASX shares that are on an upward curve, and you feel like the business can continue the momentum, why wouldn't you jump on?

Here are two such stocks that the team at Celeste Funds Management is backing for the long run:

Enjoying both external and internal tailwinds

Challenger telco Aussie Broadband Ltd (ASX: ABB) seems to be going from strength to strength this year.

The share price is now up 56.6% higher so far in 2023, and has rocketed 93.8% over the past 12 months.

Celeste analysts, writing in a memo to clients, noted just in September alone the share price soared 15.1%.

"The stock [is] climbing higher as a resolution appears increasingly likely to the extended NBN Co SAU [wholesale pricing] variation process."

While those structural changes will take effect soon and make a material impact on Aussie Broadband's fortunes, the business is also internally pivoting to future-proof its profitability.

"In August, management highlighted a renewed focus on potential acquisitions after the successful integration of Over The Wire and swiftly followed through with a non-binding indicative offer for Symbio Holdings Ltd (ASX: SYM) late in the month."

That proposal now sees Aussie enjoy an exclusive due diligence period, while outbidding rival suitor Superloop Ltd (ASX: SLC).

"The accretive acquisition would significantly boost Aussie Broadband's capability and scale in the voice space and add a number of large enterprise customers, furthering the company's diversification away from core broadband into a complete telco offering."

Just last week, analysts over at QVG also expressed their bullishness for Aussie.

"The NBN resale market may be entering a period of rational competition like that seen in the mobile market in the recent past," they said in their memo.

"Aussie Broadband continued to re-rate on the back of its strong result and guidance and supportive industry activity."

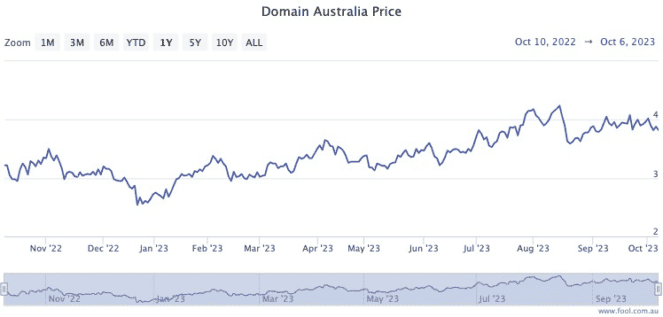

Real estate in Australia is crazy

Despite the impact of 12 steep interest rate rises filtering through the economy, the irrepressible Australian real estate market is showing signs of a resurgence.

While that's terrible news for young people trying to attain shelter, property classifieds service Domain Holdings Australia Ltd (ASX: DHG) saw its share price soar 3.9% last month.

"The stock drifted higher off the back of positive revisions to market expectations for FY24 new listings, following positive recent data points from CoreLogic and PropTrack."

Winter is usually a slow period for the real estate industry, but year-on-year change in national listings went from -5% in July to positive 4% in August.

"The market recovery has been led by Sydney and Melbourne which saw listings growth of +18% and +21% respectively in August, areas where DHG over-indexes."

With the traditionally strong spring season now in play, the Celeste team is bullish on Domain.

"The outlook remains positive into the key spring selling season with stability in interest rates likely to support strengthening consumer confidence."