It's been an underwhelming past 12 months for the Santos Ltd (ASX: STO) share price, but investors might be in for better times ahead based on a number of valid reasons.

After firing 134% higher between the depths of the COVID crash and the end of 2022, shares in this oil and gas company have coasted along, unable to hold onto a price above $8. Today, Santos shares are inching 0.3% to $7.73 apiece, less than 5% away from their 52-week high.

Still, the liquefied natural gas (LNG) producer is valued at virtually the same market capitalisation as it was a year ago.

Could this be an example of the market being irrational? Let's pop the locks and take a closer look.

Undercooking a growing need

In a recent paper titled Future Gas Strategy, the Australian Government outlines an outlook for gas that paints a dull picture for Santos and its fellow fossil fuel producers.

According to the government's research, manufacturing gas demand is expected to be in a holding pattern out to 2028. However, demand is projected to decline over the following decades, driven by lower-emission alternatives, such as hydrogen.

The International Energy Agency's Medium-term Gas Report 2023 echoes these findings.

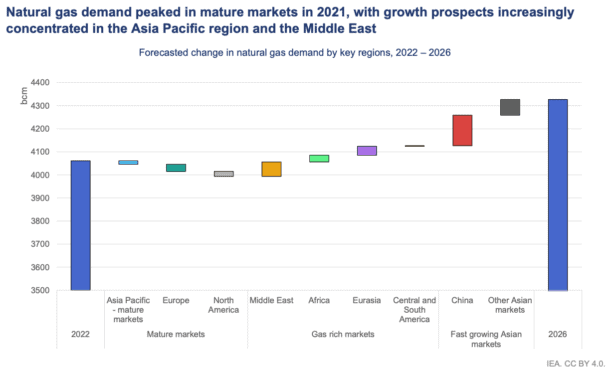

In a report released yesterday, IEA shared its forecast of global gas demand slowing from an average of 2.5% growth annually between 2017 and 2021, to 1.6% between 2022 and 2026 — pointing to the "continued expansion of renewables" — a bleak proposition for Santos shares.

Most of this incremental growth in gas demand is expected to come from China and other Asian markets, as shown in the graph below.

While the research suggests a slow decline as electrification grips the world, Santos CEO Kevin Gallagher thinks gas won't be so easily replaced.

Speaking at The Australian Financial Review Energy and Climate Summit, Gallagher explained that gas will play a role in decarbonisation. Likewise, APA Group (ASX: APA) CEO Adam Watson expressed his view that gas would be needed to fill the gaps as coal-fired power gets ousted.

Supply shock round two

A further consideration is that these reports were constructed before the conflict erupted between Israel and Gaza. This draws the supply side of the gas equation into focus, much like the invasion of Ukraine by Russia.

The spot price of LNG rocketed to record levels as supplies from Russia, historically the world's largest natural gas supplier, became stranded amid battle. Now, another large portion of the gas supply could be impacted amid geopolitical instability in the Middle East.

As we have seen with oil, the price of LNG could rise if the Israel and Hamas war weighs down production in Saudi Arabia, Israel, or Iran. Already, Israel has requested gas production grind to a halt at one of its offshore platforms off the coast of Gaza, as shown in the tweet above.

The Middle East is projected to account for nearly 15% of global gas production by 2026, according to the IEA.

Is there upside for Santos shares?

As my colleague Tony Yoo reported yesterday, Bell Potter's Christopher Watt is backing Santos shares amid worries about global energy supply.

The private wealth advisor is eyeing Santos' Barossa project as a major catalyst, with it set to deliver its first gas production in FY2025.

Furthermore, the team at JP Morgan recently raised Santos to overweight with a price target of $8.15. This would suggest a further 5.6% upside in Santos shares compared to today's price.