After the world has been witnessing the horrors in Ukraine for 18 months, another war broke out over the weekend in Israel and Gaza.

With such anxiety, the investment world has seen dividend shares enjoy popularity that they never enjoyed through the cheap-money decade of the 2010s.

The idea is that investors are fleeing to income as compensation for growth stocks that could experience vomit-inducing volatility during troubled times.

But what if you were told there are some dividend stocks that not only paid you regular income but also had excellent growth prospects?

You could eat your cake and have it too.

Believe it or not, such gems do exist. With the assistance of a couple of stock experts here is a pair that might just fit the mould:

'A chronic shortage of new dwellings'

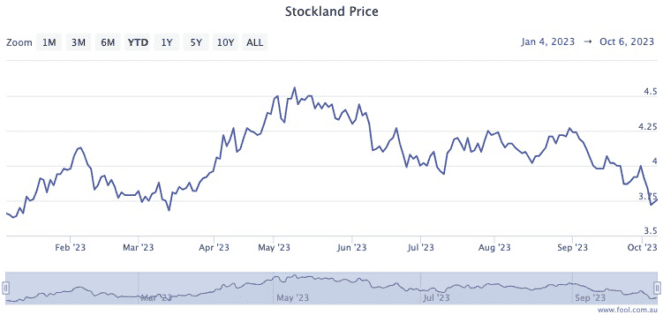

Stockland Corporation Ltd (ASX: SGP) pays out a chunky 7% dividend yield at the moment.

Even with the real estate sector facing uncertainty from a depressed economy, Catapult Wealth portfolio manager Tim Haselum is bullish on the diversified property business.

"Stockland's strategy includes expanding the industrial and residential community portfolios," Haselum told The Bull.

Despite 12 interest rate rises, he is especially excited about the residential assets.

"The medium term outlook for residential communities remains strong given increasing rates of net overseas migration, low rental vacancy rates and a chronic shortage of new dwellings across key eastern seaboard markets."

The analysts at Citigroup Inc (NYSE: C) agree with Haselum that Stockland is a buy.

"The broker is expecting the company's shares to generate some very big dividend yields in the near term," The Motley Fool's James Mickleboro reported late last month.

"It has pencilled in dividends per share of 27 cents in both FY2024 and FY2025."

Based on the current stock price, that equates to a yield of 7.2%.

A huge 'growth catalyst' coming

Aside from the obvious humanitarian concerns, for investors any sort of conflict in the Middle East brings with it worries about global energy supplies.

This makes Bell Potter private wealth advisor Christopher Watt's tip of Santos Ltd (ASX: STO) especially relevant now.

"This oil and gas explorer and producer has a diversified portfolio of mostly Australian and PNG assets," he said.

"Santos supplies domestic gas and sells LNG to international markets."

This dividend stock is delivering a tidy yield of 4.86%. But its upcoming developments are what excites Watt.

"Santos' Barossa project is expected to deliver first gas production in fiscal year 2025.

"We expect Barossa to be a growth catalyst. Risks are easing in relation to the company's execution of key growth projects."

The energy stock is wildly popular in the professional community at the moment.

According to CMC Markets, 13 out of 16 analysts currently rate Santos as a buy.