The Wesfarmers Ltd (ASX: WES) share price has been headed lower over the past month. So is the owner of Bunnings, Kmart, and others an opportunity or is it overvalued?

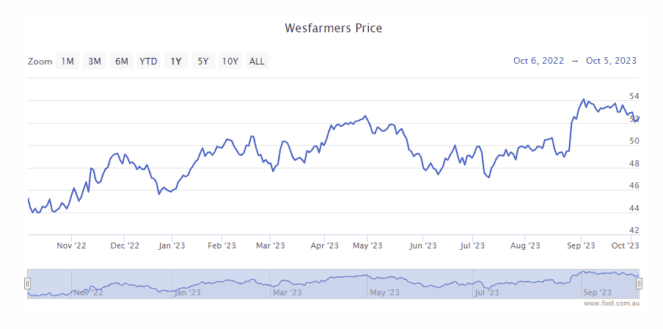

On Friday, Wesfarmers shares closed down 1.75 at $51.65 apiece. That's a 4.10% drop over the past month, as you can see on the chart below.

Is it overpriced?

There's an argument to say that the business could be overvalued. Wesfarmers is facing challenging trading conditions with households reportedly facing some tough financial decisions in the coming period after large increases in both interest rates and rents.

Wesfarmers is exposed to household spending through its various retail businesses including Bunnings, Kmart, Officeworks, Target, Catch, and Priceline.

It's possible, and probably likely, that households may decide to cut back on purchases in the current environment. A key question is how much will sales be impacted?

The immediate follow-up question is: how much is a business worth if its profit isn't growing? The price/earnings (P/E) ratio and the Wesfarmers share price are meant to capture the company's outlook. That said, investors typically give more importance to the short-term outlook rather than the long-term outlook.

Another tricky factor Wesfarmers is facing is the significant exposure to inflation. Wesfarmers is one of the largest employers in the country, so the large increase in wage costs could also significantly hamper profit growth in FY24.

According to Commsec, the Wesfarmers share price is valued at 23 times FY24's estimated earnings. I'm sure everyone would agree that the company would be more attractive if the Wesfarmers share price were cheaper than it is right now.

Why the Wesfarmers share price could still be attractive

It's true the outlook is uncertain and that there could be a significant decline in retail spending.

But I believe it's important to remember that investing is a long-term endeavour. What matters in 2024 is important for the business but 2025 is also important, as is 2026, 2027, and so on.

There may be a profit decline in FY24 — or perhaps not — but investors should think beyond the next 12 months when valuing the business.

Will the business keep delivering a good long-term return on equity (ROE)? Can Bunnings keep achieving an attractive return on capital? Will Wesfarmers continue to diversify and improve its earnings through areas like healthcare and green commodities (such as lithium)?

I think the answer to all of these questions is 'yes'. And that makes the business worth owning for the long term. It's also quite possible the business segments offering value, like Kmart and Bunnings, could gain market share during this uncertain period.

In the longer term, I think Wesfarmers can continue to benefit from Australia's population growth, sound management decisions, and potentially a growing dividend.

While it could be cheaper, it'd be one of my preferred picks in the S&P/ASX 200 Index (ASX: XJO) because of its long-term growth potential, diversification, and ability to invest across different sectors where it sees opportunities.