I'm on the hunt for ASX shares in preparation for the share market to rocket next year.

How do I know stocks are headed up in 2024?

I don't!

However, historically, years when a stock market rally has taken place have far outnumbered the years when shares fell.

That's why I don't mind making the prediction that next year will be positive, because more often than not I'll be right.

Also supporting the cause is that the S&P/ASX 200 Index (ASX: XJO) has tumbled over the past month to a point where it's pretty much back at the same level as a year ago.

Again, history tells us market fortunes are cyclical, much like its cousin the economy.

Moreover, Australians have just put 12 interest rate rises behind them. While there may be a couple more before the year is up, that can't go on forever with consumers struggling to make ends meet.

So those factors also boost the chances that my bold prediction could come true.

3 ASX shares I have bought or am tempted by

Regardless of whether I'm right or wrong about 2024, over the long term ASX shares tend to rise.

That's why it makes sense to buy shares here and now as if a stock market rally is coming.

So which ASX shares am I tempted by at the moment?

Although I generally favour growth stocks, I don't have a preconceived notion about which industry or what activities the company is involved in.

That's because diversity is important in any portfolio. You don't want to be overly reliant on the fortunes of one or even a couple of sectors, lest they strike headwinds.

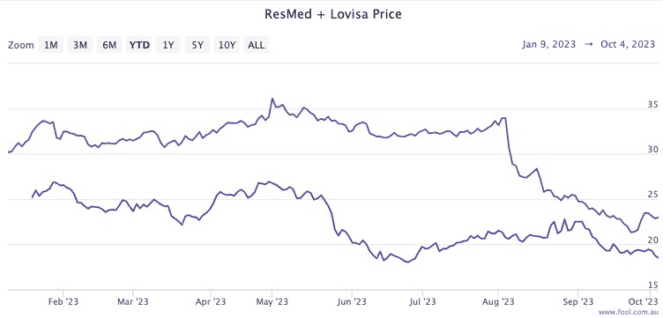

Two examples of ASX shares that I've actually bought recently are Resmed CDI (ASX: RMD) and Lovisa Holdings Ltd (ASX: LOV).

Both are somewhat bruised at the moment, with ResMed falling 31.6% since 2 August and Lovisa plunging 19.5% since 22 August.

I considered the dips a buying opportunity to pick up quality companies in health and retail.

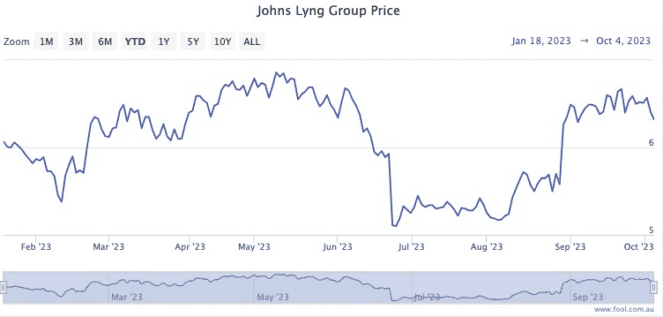

A third example that I've not bought recently but am definitely interested in is Johns Lyng Group Ltd (ASX: JLG).

I already have the insurance repairer in my portfolio but am tempted to top up with a further purchase.

This is a rare company that enjoys increased revenue and earnings from extreme weather events, which unfortunately seem to be becoming more frequent due to global warming.

I'm not the one thinking along the same lines. According to CMC Markets, eight out of 11 analysts currently rate Johns Lyng shares as a buy.