If one segment of the Australian share market has dodged the doldrums so far in 2023, it's ASX uranium shares.

Amid a rocket-like move in the price for the energy-dense metal, companies operating in the sector have soared. While the performance of many uranium producers has already been something of a fairytale, some industry experts think further upside could still be on the table.

Here's what could catapult ASX uranium shares even higher.

Increased supply doesn't come cheap

Two variables govern the price of any commodity: supply and demand.

For uranium, the demand story is well understood by many. Nuclear is regaining its position as an alternative energy source as climate concerns intensify and energy security is thrown in the spotlight amid strained geopolitical ties.

Consequently, governments in the United States, Canada, Japan, China, Poland, and Turkey have delivered — or announced the development of — new reactors for the first time in decades.

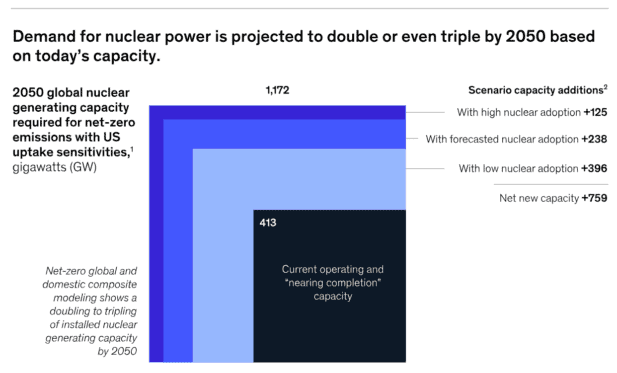

Global consulting giant McKinsey & Company noted that demand for nuclear power is forecast to double or triple by 2050, as pictured below. Not too many industries can attest to having that level of projected demand growth over the next 27 years.

However, one industry expert believes the critical catalyst for the uranium price is on the supply side of the equation.

In an interview last week, Uranium Insider founder Justin Huhn explained that utilities are struggling to get ahold of the supply they need, stating:

They're having a hard time finding the uranium they need at any price. We're actually approaching that situation here — it's a bit alarming. But, from an investment standpoint, it's quite exciting.

Adding:

It's a structurally undersupplied market, and nobody knows where that relief is going to come from.

As it stands, there are numerous factors inhibiting projected uranium supply, including:

- Cameco (one of the largest global uranium providers) downgrading production

- A coup in Niger, potentially disrupting a major supplier to France's 56 nuclear power plants; and

- Russia's increasing interest in Kazakhstan-based uranium producers

In turn, Huhn expects the uranium price will need to fetch between US$85 to US$100 per tonne to incentivise new supply. For reference, uranium is currently going for US$73 per pound — the highest price in 12 years.

Are ASX uranium shares still a buy?

The next question is: is it still worth buying uranium shares? After all, these companies have already flown higher than a weather balloon this year.

- Paladin Energy Ltd (ASX: PDN) up 56.8% year-to-date

- Boss Energy Ltd (ASX: BOE) up 124.6%

- Deep Yellow Limited (ASX: DYL) up 78.6%

- Bannerman Energy Ltd (ASX: BMN) up 61.4%

According to a few analysts, there are still pockets for possible growth. For instance, the team at Macquarie are bullish on Paladin Energy. Likewise, Shaw and Partners consider Paladin a "core holding" within the sector.

Meanwhile, Bell Potter is taking a liking to Deep Yellow with a speculative buy on the ASX uranium share.