The owners of AMP Ltd (ASX: AMP) shares can rejoice – they're getting their dividend payment today.

It's been a rough few years for the ASX financial share following the Royal Commission into financial services and advice. The Commission's report singled out AMP for continuing to charge fees to customers who had died and selling unnecessary products.

Since then, the company has seemingly made considerable effort to put things right. It's now in a position to start regularly rewarding shareholders with dividends again.

How much dividend cash are shareholders getting?

The AMP board decided to declare a dividend of 2.5 cents per share. So if someone had 1,000 AMP shares, they'd get a $25 cash dividend. The AMP dividend isn't fully franked — it's partially franked to 20%. The other 80% of the dividend is unfranked.

The ASX financial share was easily able to afford this level of dividend after generating underlying earnings per share (EPS) of 3.8 cents. This was 11.8% growth year over year.

AMP said it had $610 million of capital returned to shareholders since August 2022, with a further $140 million expected to be returned by 31 October 2023 through an interim dividend and what's left of the company's share buyback.

What are the future intentions?

After completing its capital and balance sheet review, AMP decided to pay down debt to "improve financial resilience", with $302 million of corporate debt paid down in July.

It also said it intends to return capital "prudently in relation to the resolution of litigation outcomes".

Management said that it will continue with simplification of its legal and operational footprint to "benefit liquidity and cost management". It said:

While remaining committed to returning surplus capital to shareholders, given the current uncertainty surrounding the outcome of the Financial Adviser Class Action and other litigation matters, Tranche 3 of the capital return program has been paused.

An update will be provided no later than 31 December 2023.

AMP dividend projections

Commsec projections currently suggest AMP could pay an annual dividend per share of 5 cents in FY23, which would be a partially franked dividend yield of 4% at the current AMP share price.

In FY24, the annual dividend per share could be 5.8 cents per share, which would be a partially franked dividend yield of 4.6%.

AMP share price snapshot

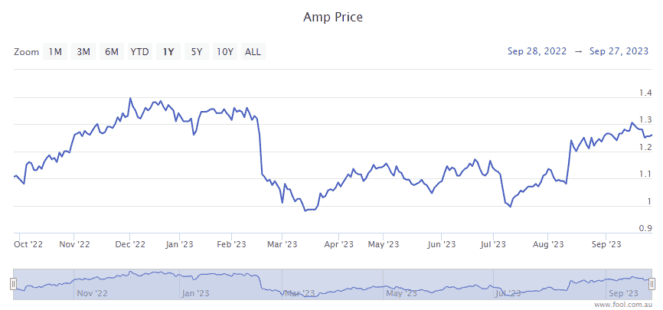

AMP shares have fallen 3% since the start of 2023. However, the AMP share price is 13.5% higher than it was 12 months ago.