Has the Reserve Bank of Australia pushed Australians too far?

The impact of 12 interest rate rises worth 400 basis points is, understandably, devastating both consumers and businesses.

Will the consequence be that the country will fall into recession?

Only last month AMP Ltd (ASX: AMP) chief economist Dr Shane Oliver thought the chances were horribly high.

"Rapid monetary tightening points to a high risk of recession and, given lags in the way it impacts the economy, just because it hasn't happened yet does not mean it won't," Oliver said.

"It's a high risk with the lagged impact of [interest] rate hikes still feeding through – particularly in Australia where we put the risk of recession at 50% given the vulnerability of the household sector."

In such tough times, some investors like to shelter beneath ASX dividend shares, as regular income gives them comfort during anaemic capital growth.

If you're one of those people, then you might like to consider these All Ordinaries Index (ASX: XAO) stocks:

'Substantially boosting group earnings quality'

While mining company South32 Ltd (ASX: S32) didn't pay out a massive special cash dividend like it did last year, the yield stands at a respectable 3.7% fully franked.

And with the heavily cyclical nature of the resources sector, one could argue buying now during bleak times provides more upside than down.

Indeed, according to CMC Markets, eight out of eight analysts currently believe the All Ords stock is a buy.

Morgans analysts are bullish on the stock, which they put down to the way South32 has rotated its minerals production.

"S32 has transformed its portfolio by divesting South African thermal coal and acquiring an interest in Chile copper, substantially boosting group earnings quality, as well as S32's risk and ESG profile."

"Unlike its peers amongst ASX-listed large-cap miners, S32 is not exposed to iron ore."

Who doesn't like 9% dividend yield?

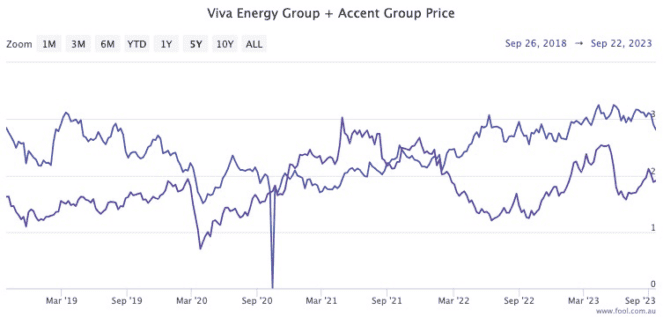

While consumer discretionary might be the last sector on investors' minds when facing a recession, Accent Group Ltd (ASX: AX1) has been showing remarkable resilience.

Not only is the share price up 13.7% so far this year, the All Ords member is paying out an eye-opening dividend yield of 9% fully franked.

According to The Motley Fool's James Mickleboro, the team at Bell Potter loves Accent for its income production.

Viva Energy Group Ltd (ASX: VEA) is also pumping out dividends like it's going out of fashion.

The dividend yield currently stands at a stunning 9.3%, fully franked.

The All Ords stock has plunged in excess of 8% this month, which Seneca Financial Solutions investment advisor Arthur Garipoli thought presented a golden chance for investors.

"The share price fall provides long term investors with a buying opportunity in a high quality business seeking growth."