ASX uranium shares are exploding this year, with three stocks hitting 52-week highs yesterday.

Paladin Energy Ltd (ASX: PDN) shares reached a new annual peak of 99 cents on Monday. Their run continues today with the Paladin Energy share price hitting $1.04 in morning trading.

Deep Yellow Limited (ASX: DYL) shares hit a high of $1.125.

And uranium micro-cap Devex Resources Ltd (ASX: DEV) leapt to 42 cents per share.

Last Friday, Boss Energy Ltd (ASX: BOE) shares also reached a new 52-week high of $4.48 per share.

If we take a 12-month view, these ASX uranium shares have been on a northwards surge since May.

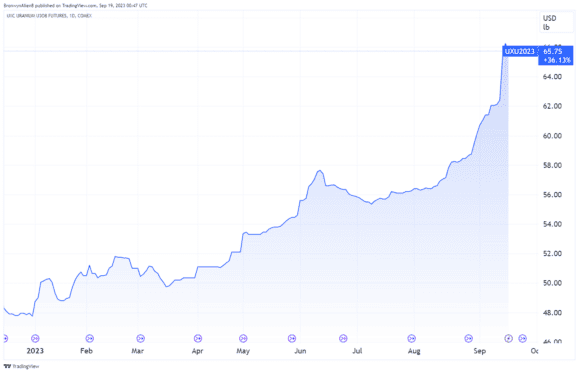

This corresponds with a lift in the uranium price over the same time period, as shown below.

Uranium is one of very few commodities projected to rise in value over the next five years.

Should you buy ASX uranium shares?

Fund provider BetaShares says there are six trends driving ASX uranium shares higher, including higher demand amid low supply and decarbonisation.

Perceptions of ASX uranium shares are possibly shifting in the green energy era and in light of the AUKUS defence deal. Nuclear energy is CO2-free.

Braden Gardiner from Tradethestructure is recommending Paladin Energy shares as a buy.

Gardiner told The Bull:

With the uranium price moving higher, we expect Paladin Energy's share price to move to new short-term highs.

The uranium miner has spent the past two years in a broad range between support at 53 cents and resistance of around $1.

Federal Opposition calls to include nuclear power in Australia's energy mix have ignited debate to the benefit of PDN.

Moving forward, we see the shares increasing to well beyond $1.

According to the Westpac trading platform, six out of six analysts covering Paladin Energy shares rate them a strong buy.

The role of nuclear energy in Australia's future

According to The Australian, energy executive Jason Willoughby has shot down the federal opposition's proposal to convert coal-fired power stations into modular nuclear reactors as part of the energy transition.

Willoughby is the CEO of renewables developer Squadron Energy, which is owned by Fortescue Metals Group Ltd (ASX: FMG) boss Andrew Forrest.

He said:

The economics are clear: we need to act now to build wind, solar and batteries, not wait for a more expensive solution that won't be available for more than a decade, at the earliest.

Federal Energy Minister Chris Bowen says 71 small modular reactors (SMRs) would cost $387 billion.

Meantime, chair of the Net Zero Australia Steering Committee Robin Batterham said nuclear power could be a viable energy source if costs came down.

Batterham said:

Costs do come down with time.

When they come in, if the cost comes down … then they would have a role.

Currently, they are just not in the race.