There aren't too many S&P/ASX 200 Index (ASX: XJO) tech shares among the top companies globally. Former WAAAX shares Xero Limited (ASX: XRO) and WiseTech Global Ltd (ASX: WTC) may arguably be considered two of the ASX's finest.

Xero is a global provider of cloud accounting services to small and medium businesses. WiseTech is a logistics software business that has clients around the world.

According to the latest updates, Xero has 3.74 million subscribers. WiseTech says that its customers comprise 18,000 of the world's logistics companies across 173 countries, including "43 of the top 50 global third-party logistics providers and 24 of the 25 largest global freight forwarders worldwide".

They are both impressive companies. Let's look at how they compare on a couple of key measures.

Growth rate

One of the most important things influencing how big a business becomes is how quickly it grows.

In the FY23 half-year result to 31 December 2022, WiseTech's revenue increased by 35% to $378.2 million. In Xero's FY23 result to 31 March 2023, operating revenue rose by 28% to NZ$1.4 billion. On that measure, WiseTech grew more strongly, and its organic CargoWise revenue jumped 46%.

However, WiseTech is expecting FY23's revenue to grow between 26% to 30%, which is very similar to Xero's FY23 growth figure.

Free cash flow is also an important profit measure, so we'll look at the growth of that for the ASX 200 tech shares as well. Xero's FY22 free cash flow was only NZ$2 million. It grew to NZ$102 million in FY23, an increase of NZ$100 million.

WiseTech's HY23 free cash flow rose by 53%, or $47.5 million, to $137.8 million. While the growth rate was slower, WiseTech's free cash flow margin on revenue was 36% — significantly higher than Xero's.

But, Xero expects profit to increase significantly next year as it more evenly balances growth with profitability.

Valuation

It's not easy to value Xero because it's not reporting a net profit yet, but I think that's going to change (significantly) over the next few years.

Commsec numbers suggest that Xero shares could be priced at 85x FY25's estimated earnings. Commsec projections show that WiseTech is valued at 61x FY25's estimated earnings. Even this may not reflect how much further Xero's profit can rise as its margins 'normalise'.

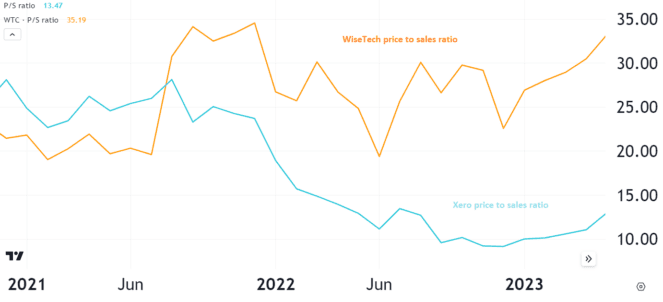

But, there's another way to compare the ASX 200 tech shares, the price-to-sales ratio. It's not a perfect valuation, but it's quite useful when comparing businesses yet to make a profit.

When looking at this, it seems there's a significant difference, with Xero being the cheaper business by some distance on the price-to-sales ratio, even if we use WiseTech's guided revenue for FY23 of between $790 million to $822 million.

Foolish takeaway

Both ASX 200 tech shares are high-quality, and they're both priced to reflect that. Out of the two, I think I'd go for Xero because of the lower price-to-sales ratio and expected higher profitability over the next few years.