With interest rates going up and up in a seemingly endless tightening cycle (the latest being just this week), talk has been growing about a possible recession. It is an extremely hard thing to cool an inflation-ridden economy without inducing a recession. Central banks have often tried in the past, but few have succeeded.

We all hope that the Reserve Bank of Australia (RBA) can pull off its soft landing for our economy over the rest of 2023 and into 2024. But sometimes, it's best to hope for the best and plan for the worst.

In this spirit, today we're checking out three ASX shares that managed to grow their earnings through the last global recession that wasn't caused by a pandemic, the global financial crisis of 2007-2009.

3 ASX All Ords shares that grew earnings during the GFC

Computershare Ltd (ASX: CPU)

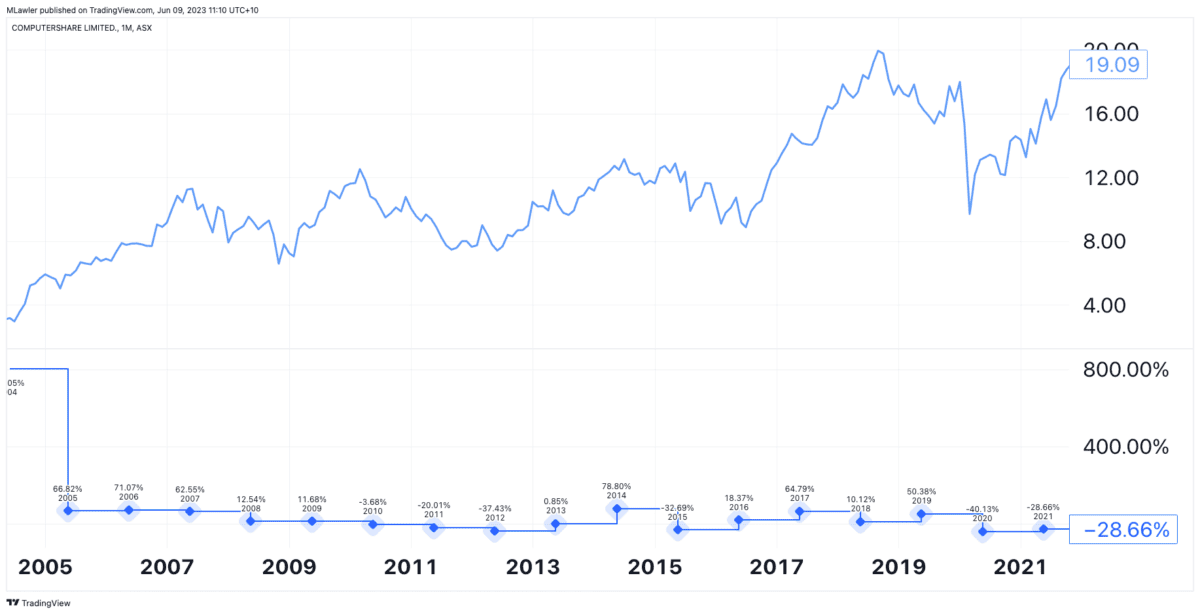

ASX tech stock Computershare is first up to check out. This provider of regulatory and financial services (including share registries) showed remarkable resilience to the nasty economic downturn that accompanied the global financial crisis, as you can see below:

You'll notice that Computershare grew its earnings by 62.55% in 2007, a reduced-but-still-positive 12.54 in 2008 and 11.68% in 2009. That solid performance is a great sign that Computershare has a stable and resilient earnings base.

InvoCare Limited (ASX: IVC)

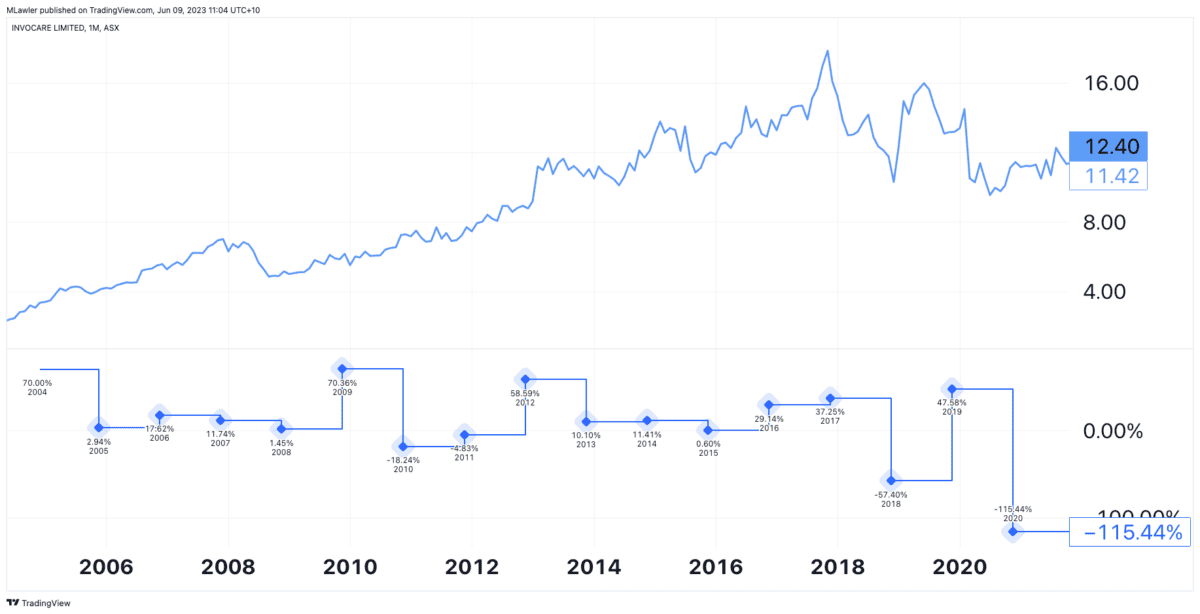

Next up is ASX All Ords funeral services share InvoCare. This one can be delicate to discuss — no one likes considering financial earnings when we are talking about funerals and the like.

But the fact remains that death is one of life's few certainties. And we all want to send off our loved ones with respect and dignity, regardless of the health of the global economy. Those services need to be provided, and InvoCare is one of the more popular choices with Australians, with its brands like White Lady Funerals and Simplicity.

As you can see below, the global financial crisis did little to dent InvoCare's earnings. The company recorded earnings growth of 11.74% in 2007, 1.45% in 2008 and a whopping 70.36% in 2009.

Woolworths Group Ltd (ASX: WOW)

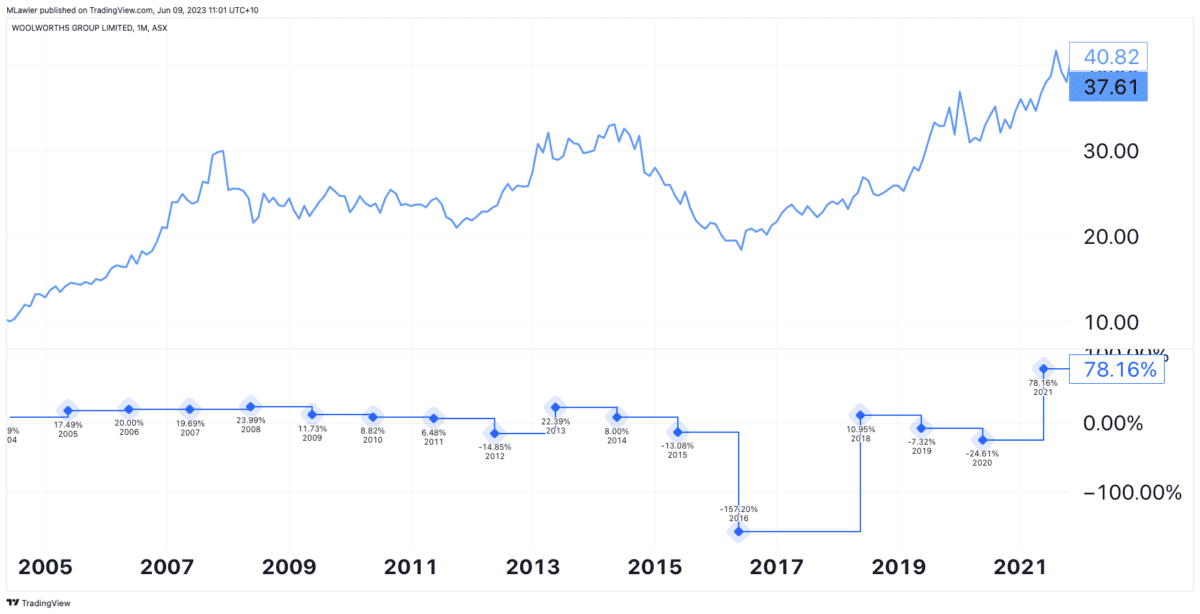

Now, onto a more everyday topic in groceries. Woolworths is often touted as one of the shares with the safest earnings base on the ASX. Looking at the data from the global financial crisis, we can see why:

The company recorded some healthy earning growth during the recession back in 2007-2009. 2007 saw Woolworths grow its earnings base by 19.69%, which was backed up by another 23.99% in 2008 and 11.75% in 2009.

Consumer staples shares like Woolworths are always going to fare better than most in dire economic times. That's simply thanks to the fact that we all need to eat, drink and stock our houses with life's essentials, regardless of the economic weather. This is quantified in the graph above and demonstrates why this All Ords share remains one of the ASX's most popular.