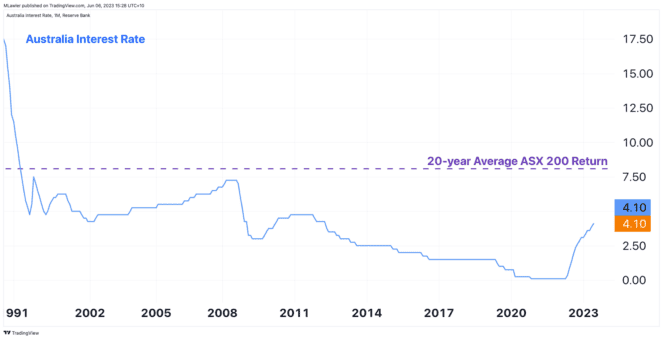

The S&P/ASX 200 Index (ASX: XJO) is down 0.9% in the past year. Its underwhelming performance likely prompting investors to ponder whether ASX shares are worth their time and money. After all, a 'risk-free' return of more than 4% is now possible again on cash.

What shouldn't be forgotten is that the benchmark has generated a return of 8.1% per annum on average over the past 20 years — a number that the Australian cash rate has not exceeded since 1991, as shown below.

I'm confident Australian shares will prove to be a superior investment to cash over the next 20 years. Truthfully, I believe the next six to 12 months will be an opportunistic time to be buying high-quality companies at attractive valuations as many find themselves succumbing to short-term thinking.

What I'm looking for in a long-term investment

You might be wondering why I would opt for a 10-year time horizon. Some consider five years a long enough holding period.

However, research shows that between 1980 and 2018, the S&P/ASX 300 Index produced a positive return 100% of the time over a rolling 10-year timeframe. Your mileage may vary depending on which ASX shares are in your portfolio, but longer holding periods tend to be more forgiving.

Even more critical is finding companies with solid foundations. As evidence of such foundations, I like to see the following in my investable candidates:

- Founder-led and/or management team with skin in the game

- Responsible use of debt, if not debt-free

- Operating in industries with structural growth

- Sustainable competitive advantage

So, which 10 ASX shares would I invest $1,000 each into for the long haul?

Allocating $4,000 to ASX small-cap shares

The small end of the market capitalisation spectrum can often be ripe for finding underappreciated businesses. Especially now when high growth rates are leaving investors largely unimpressed unless it's paired with profits.

Two fast-growing small-caps that are led by people with a fair wad of equity in the company are Clinuvel Pharmaceuticals Limited (ASX: CUV) and Tuas Ltd (ASX: TUA).

These businesses are worlds apart in terms of what they do, with one developing healthcare solutions for unmet needs and the other a telecom company in Singapore. Though, both are making strides at breaking into more markets with passionate leaders at the helm.

The next two small caps that catch my eye operate in industries experiencing structural growth. Both Megaport Ltd (ASX: MP1) and Propel Funeral Partners Ltd (ASX: PFP) could ride a wave of greater demand for their services over the next decade.

Firstly, Megaport is a networking software company that provides on-demand flexible access to multi-cloud configurations and private network porting. After stripping out millions in operational expenses and increasing prices, I'm optimistic Megaport could evolve into a much larger business.

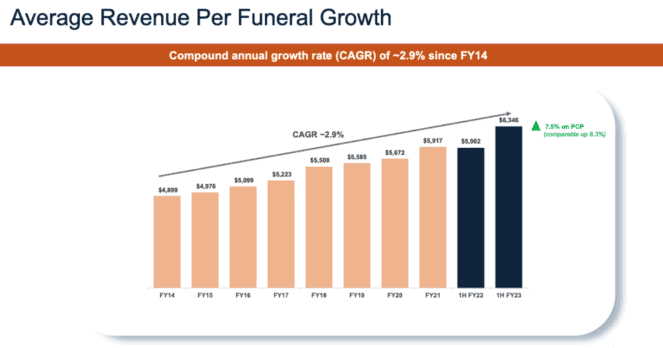

Secondly, at 27 times earnings, Propel's growth is arguably going unnoticed. This ASX share is rapidly gaining market share as it consolidates the funeral services industry.

Operating in a country with an aging population, I believe this is one of the most well-placed businesses to benefit. Not to mention that it has grown its average revenue per funeral at a compound annual growth rate (CAGR) of 2.9% over the past nine years (7.5% in the latest half), as pictured above, mostly negating the impacts of inflation.

The exceptional ASX mid-caps shares I'd buy

Moving to larger waters, the mid-cap space of the Australian share market is filled with quality companies. Among them, my preference for a decade-long hold would be those that have demonstrated the ability to sustain high growth and are leaders in their field.

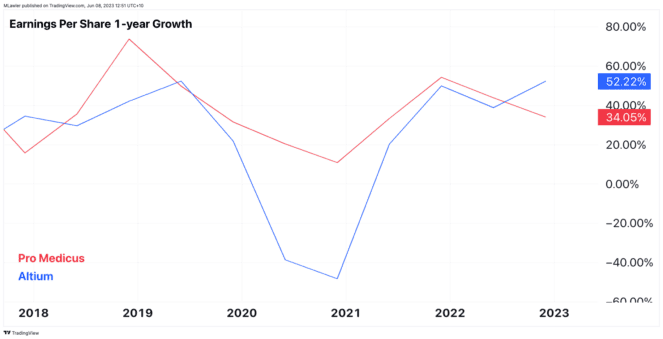

The first two ASX shares that come to my mind are Pro Medicus Limited (ASX: PME) and Altium Limited (ASX: ALU). Both the medical imaging company and the circuit board design software business have increased their earnings by an order of magnitude over the past decade.

You would think the pace of growth would be beginning to level out. On the contrary, last year their earnings increased by 34% and 52% respectively, as depicted in the chart below. Reassuringly, Pro Medicus is still led by its two co-founders.

Additionally, GQG Partners Inc (ASX: GQG) and TechnologyOne Ltd (ASX: TNE) make my list due to their extraordinary track records to date. The debt-free balance sheets of the two provide the comfort to rest easy during our hypothetical 10-year timeframe.

Investing in the biggest and the best

Finally, to round out a horde of potentially high achievers over the next decade, I'd be buying $1,000 worth of Fortescue Metals Group Ltd (ASX: FMG) shares and Betashares Nasdaq 100 ETF (ASX: NDQ) units.

These last two selections would give a long-term portfolio some diversification across mining and reduce the geographic risk. However, it is one key characteristic that I believe makes these two investments valuable — moat.

For Fortescue, the competitive advantage is its low cost of production and extensive mine-to-port infrastructure. At around US$17.73 per wet metric tonne, the miner is one of the world's lowest-cost producers of the steelmaking material.

Furthermore, at approximately 7 times earnings for this ASX share, I would argue there is no value being assigned to its green hydrogen developments. Whilst may be a hindrance in the short term, this moonshot venture could end up being lucrative.

Likewise, the Nasdaq 100 ETF provides exposure to businesses with some of the widest moats in existence. Take Microsoft Inc (NASDAQ: MSFT) and Apple Inc (NASDAQ: AAPL) for example. Two companies that have billions of customers stuck like glue to their respective operating systems.

Final thoughts

Right now might feel like the wrong time to invest in ASX shares. However, if long-term compounding is the goal, the evidence suggests there is hardly ever a 'bad time' to buy quality companies.

In my opinion, current interest rates are a sugary hit for returns. Eventually, they will come down from their high — and, more than likely, many investors will be left scrambling to get back into the market after the rally.

As such, I'll be sticking to the strategy that has proven itself time and time again.