Embattled Zip Co Ltd (ASX: ZIP) shares have plateaued year to date, closing at 51 cents apiece on Thursday, exactly where they started 2023. It leaves the global buy now, pay later (BNPL) company's share price a staggering 97.6% below its all-time high.

But with the company's plans to concentrate on the US and Australia-New Zealand markets, could this one-time market maestro be laying the groundwork for its Second Act?

We asked two of the Foolish team to outline the bull and bear cases for buying Zip shares.

Don't count Zip out just yet

By Monica O'Shea: I am bullish that the Zip share price can rise in the future based on a few key factors.

Firstly, Zip shares at 51 cents could be very cheap when you consider their all-time high of $12.35 on 12 February 2021.

If the company delivers on its strategic priorities, the Zip share price may have the capacity to lift. Although that said, I can't see the company trading above $10 anytime soon.

Secondly, I believe Zip's plan to deliver sustainable growth in the United States and Australia-New Zealand markets could provide momentum going forward.

In its third-quarter results update, Zip reported it is "on track" to achieve positive cash earnings before tax, depreciation, and amortisation (EBTDA) in the first half of the 2024 financial year.

If Zip returns to profit, then investors may have more confidence in the company's long-term prospects, in turn, boosting its share price.

It's also worth noting the company's cash transaction margin lifted 2.8% in the third quarter of FY23, despite higher interest rates.

Zip's CEO and co-founder Larry Diamond moved to the US in October 2022, where he sees "significant opportunity". Consumer spending in the US rose by 0.8% in April, more than expected.

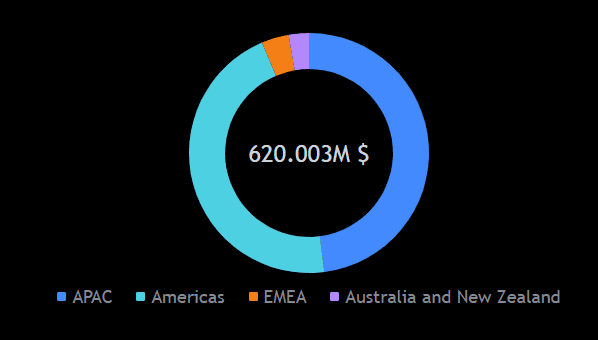

Indeed, Zip reaps the vast majority of its revenue in the American and Asian markets, as illustrated below.

Thirdly, regulatory changes to the BNPL industry in Australia could be an advantage for Zip shares. Under changes announced by federal Financial Services minister Stephen Jones in May, the BNPL sector will be regulated under the Credit Act.

While this might not sound like a welcome development, Zip believes this will provide the company with a "competitive advantage". Unlike some other BNPL players, Zip already holds a credit license and conducts affordability checks on its customers.

And we don't need to just take Zip's word for it. The team at Shaw and Partners also believes Zip may be a "big winner" from the new regulations. Analysts believe the changes will "level the playing field", requiring other providers to clear the same hurdles Zip already has in place.

Overall, I am optimistic the Zip share price can lift higher within the next twelve months.

Management's target is not enough

By Mitchell Lawler: The issue I have with Zip shares is a three-part affair, boiling down to: viability, dilution, and competition.

While the company's management would have hoped to quell the first two matters with its third-quarter update on 20 April – citing improving margins and a targeted 50% improvement in EBTDA in the second half – the release did little to improve my own outlook on the business.

An improvement in EBTDA would certainly be a move in the right direction. However, this metric disregards the capital intensity of extending credit to its customers, which strains the company's cash flow.

There is nothing to indicate that Zip could achieve positive EBTDA and still post large negative cash flows from its operations. This should be the main area of concern for management – and shareholders – to put the business on a viable path.

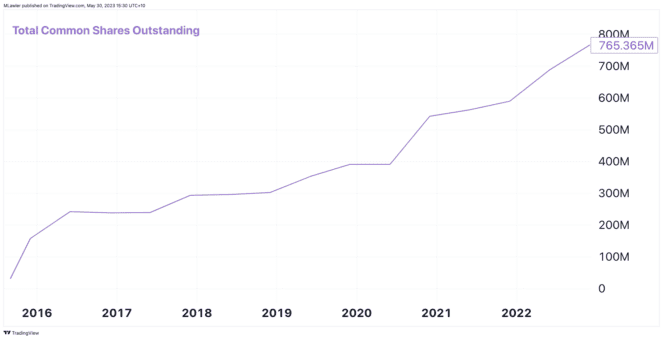

If not controlled, continued cash outflows would most likely lead to further shareholder dilution through additional capital raises. This is an issue shareholders have been facing for many years now, as total share count has grown from ~157 million shares in 2015 to more than 765 million shares in 2022, as shown below.

Lastly, assuming Zip can achieve positive cash flow and sustain itself moving forward, the competition will remain fierce.

We're talking about companies that are arguably far better capitalised than Zip. Giants such as Apple Inc (NASDAQ: AAPL), PayPal Holdings Inc (NASDAQ: PYPL), and Block Inc (NYSE: SQ) are all now involved in the buy now, pay later arena.

The challenge for Zip is trying to overcome, or even maintain, market share against businesses that I believe have superior product distribution.

Apple taps into over one billion devices, PayPal already holds 429 million active accounts on file, and Block is in the pockets of more than 50 million Cash App users. Meanwhile, Zip attests to around 7.2 million active customers, but has no secondary or existing relationship to grow its base cheaply.

The above reasons are why I remain bearish on Zip shares until it can prove to operate on a far lower cost base.