The Flight Centre Travel Group Ltd (ASX: FLT) share price is taking off on Monday, starting the week off with a new major milestone.

The stock roared to a peak of $21.775 this afternoon, marking a 2% gain on its previous close. That's the highest it's been in over 18 months – and just 5% off its post-pandemic high.

So, what's got under the wings of the S&P/ASX 200 Index (ASX: XJO) travel agency lately? Let's take a look.

Flight Centre share price soars to 52-week high

The Flight Centre share price has been on its own journey lately, rising close to 51% since the start of 2023. It's also now 140% higher than it was in March 2020.

The ASX 200 travel stock was among those hardest hit when Australia's borders were slammed shut in an effort to subdue the virus that took the world by storm in 2020.

And it's not just the company's stock that's been outperforming lately.

Flight Centre's total transaction value (TTV) surpassed pre-pandemic levels in March, beating that of March 2019 by 6%, the company revealed last week.

Not to mention, its underlying cost margin is at a historic low, reflecting structural changes made at the height of the pandemic.

So, with such positive momentum, is it just a matter of time before the Flight Centre share price recovers to its pre-pandemic levels? Well, there might be more than meets the eye when it comes to the travel stock's valuation in 2023.

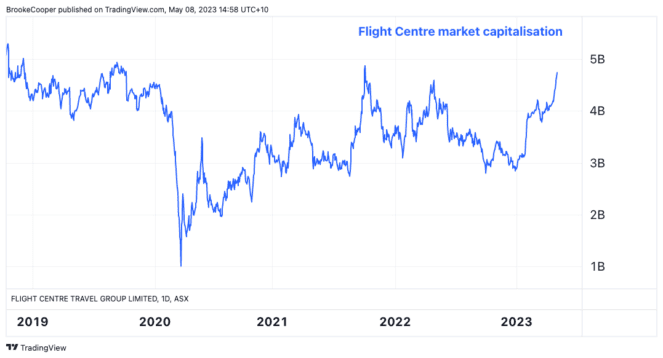

Flight Centre shares are still trading 40% lower than they were prior to the pandemic. However, the company's market capitalisation is near to where it was in late 2019, as the chart below shows:

That's largely due to a $700 million capital raise undergone in 2020 in an effort to shore up its finances.

The raise nearly doubled the company's outstanding share count, with securities priced at $7.20 apiece.

Thus, Flight Centre's valuation already sits around its 2019 level – at $4.7 billion as of Friday's close.