Ah, Woolworths Group Ltd (ASX: WOW) shares versus Coles Group Ltd (ASX: COL) shares. The age-old ASX 200 battle. Many Australians struggle with the choice between these two supermarket giants when deciding where to do their weekly grocery shopping.

But today, we're asking which would be the better buy right now.

Woolworths and Coles are two of the most similar businesses on the ASX. Both have large and established presences in the Australian grocery and liquor sectors, forming two halves of a relatively cosy duopoly. Both have been around for decades (although Coles has only been listed on the ASX since 2018).

And both ASX 200 shares are rolled-gold consumer staples blue chips, with solid, fully-franked dividend payouts. But going forward, there is going to be a winner or a loser. So how do we figure out which is which?

Which ASX 200 grocery store has been the better past performer?

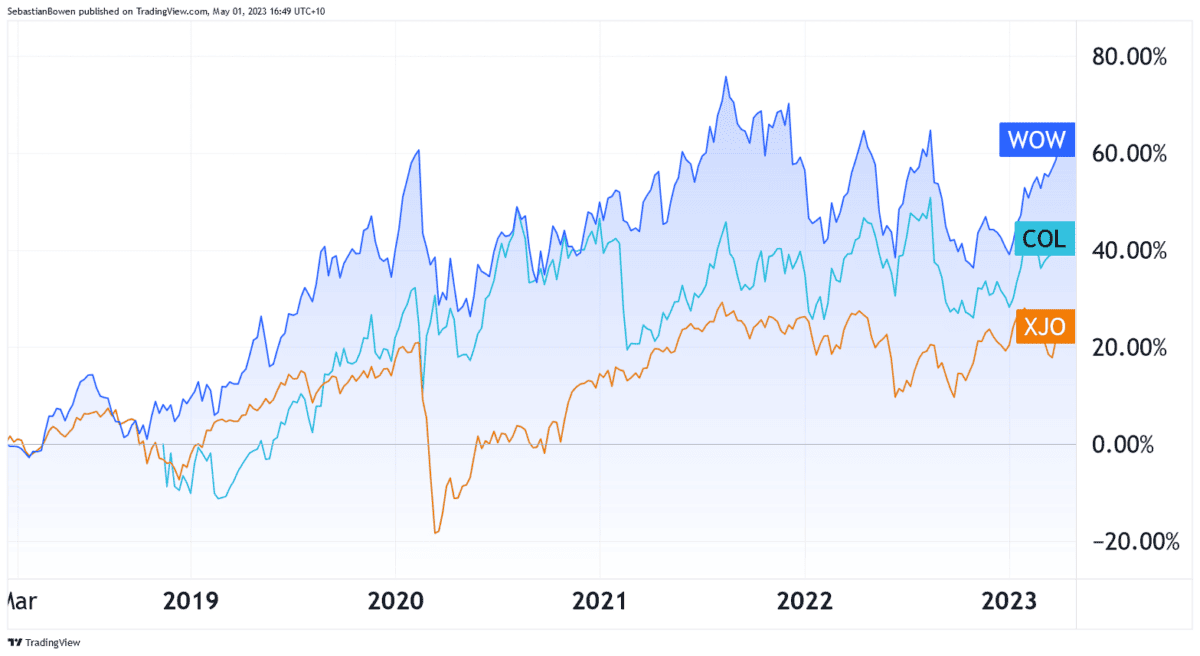

Well, let's start at the bottom. Both the Woolworths share price and the Coles share price have been market-beating performers over the past five years. Woolies and Coles' shares have both outperformed the S&P/ASX 200 Index (ASX: XJO) as you can see below:

Woolies is the clear winner, but Coles' performance has been nothing to turn one's nose up against either.

But, as we all know, past performance is no guarantee of future success. So let's look at some fundamentals for both companies:

| Woolworths | Coles | |

| Share price (at the time of writing) | $38.68 | $18.22 |

| Market capitalisation | $47.4 billion | $24.49 billion |

| Price-to-earnings (P/E) ratio | 28.33 | 21.74 |

| Trailing dividend yield | 2.56% | 3.62% |

| Revenue (FY22) | $60.85 billion | $39.4 billion |

As we can see, Woolworths is by far the larger company here. In fact, Coles is close to half the size of Woolies.

In some ways, this makes sense. Woolies turned over more than $60 billion in revenues in FY2022, while Coles did two-thirds of that, with just under $40 billion. This translates into Woolies being the clear market leader when it comes to the share of the Australian grocery pie.

Woolworths shares have a lot going for them

According to Statista, Woolworths commanded 37.1% of the Australian grocery market in FY2022, with Coles grabbing a 27.9% share.

Both companies' German arch-rival Aldi has a 9.5% stake, while the Metcash Ltd (ASX: MTS)-supplied IGA chain held onto 6.9%. The remaining 18.6% came from other, smaller grocery retailers.

So Woolworths definitely deserves to trade at a larger size than Coles, by virtue of its higher market share, and greater revenues.

But what the fundamentals also tell us is that the market is placing a higher premium on Woolworths shares compared to Coles. This is evident in Woolworths' higher P/E ratio of 28.33, against Coles' 21.74. This tells us that investors are prepared to pay $28.33 for every dollar of earnings Woolworths makes, but only $21.74 for every $1 that Coles rings up.

This is one of the reasons why the Coles dividend yield is so much larger than that of Woolworths.

Woolworths vs. Coles shares: Which is the better buy?

So we as investors have to decide if this premium for Woolies shares that the market is asking is justified. In my opinion, Woolworths is the superior business. It has a clear market lead, which it has been able to maintain for years now.

While I would personally like to see both companies trade at a cheaper share price to justify a buy, gun to my head, it would be Woolworths. I think this company has more potential to compound its earnings over a long period of time than Coles.

However, if I were a retiree and depended on dividend payments to fund my expenses, the higher dividends from Coles would probably sway me over to the other side.