Extra income is an appetising proposition that is hard to pass up. The idea of getting paid to hold an asset while doing no direct work for it entices many of us who are seeking financial freedom. It's no wonder ASX dividend shares can often be found in the average Aussie's portfolio.

However, like the sweetness of sugar, there can be too much of a good thing. Right now, swathes of investors are prioritising near-term returns (such as dividends) over future growth.

In response, 'growth' companies are getting booted to make room for dividend-paying alternatives. This move might look good on paper, for now, but I believe there are potential downsides to a completely dividend-centric portfolio.

Let's unpack some important considerations before going 'all-in' on ASX dividend shares and abandoning growth altogether.

All the rage right now

It's hardly a surprise that people are turning more toward dividend stocks at a time when money is tight. Inflation is still eroding the purchasing power of our currency and the uptick in interest rates has put those with a mortgage in a stranglehold.

The reality is, a stake in a company doesn't help pay the bills unless it is sold or provides dividends. As such, investors who still want exposure to the stock market — but are in need of additional cash — are more likely to turn to ASX dividend shares.

I'm not going to say whether that is a right or wrong choice. The truth is such decisions are highly dependent on individual financial circumstances. Though, investors could be switching to a sole dividend focus on what could be short-term conditions.

A bribe in exchange for accepting mediocrity

There's a great quote from Charlie Munger (Warren Buffett's right-hand man at Berkshire Hathaway), which reads:

Using volatility as a measure of risk is nuts. Risk to us is 1) the risk of permanent loss of capital, or 2) the risk of inadequate return.

I think there is a common misconception that simply because a company pays a dividend it is 'less risky' than more volatile shares such as those in the growth bracket. Management can destroy capital regardless if a dividend is being paid or not.

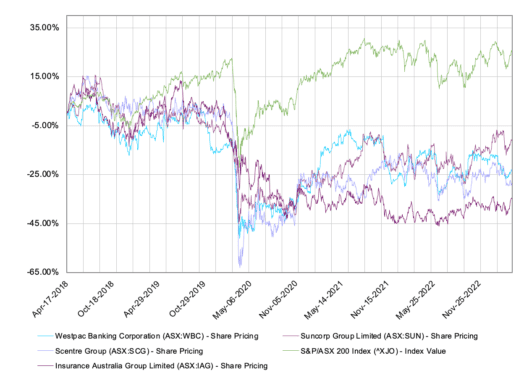

Take for example the ASX dividend shares shown in the chart below. Each of these companies could be considered relatively 'safe' dividend-paying investments. Yet, all of them have underperformed the S&P/ASX 200 Index (ASX: XJO) over the past five years — even when dividend returns are included.

Ultimately, this reveals the durability — or lack thereof — of a company's economic moat or competitive advantage. If dividends can't be paid while also retaining a high return on equity (ROE), then more purposeful uses for those funds should probably be found.

Not all ASX dividend shares are poor compounders

Don't get me wrong, there are plenty of high-quality dividend shares on the ASX. Such companies are able to pay out profits while simultaneously growing them.

The point is I wouldn't invest in a company purely based on whether or not it pays a dividend.

In my opinion, it is far more important to make a decision based on the fundamental quality of the business and the potential for long-term compounding. In some cases that will be a company that pays a dividend. At other times, it possibly might not.

For reference, 26 out of the 50 best-performing ASX shares over the last decade did not pay a dividend in the last year.

The ASX shares I'm eager to buy (dividends or not)

Personally, I much prefer high growth over high yield. As such, a large runway for growing profits is the first characteristic I look for when hunting for investments. From there, dividends are treated as the cream on top if they're offered.

The track record of growth, management experience and ownership, balance sheet health, and competitive edge take the front seat over dividends. Right now, ASX shares that are catching my eye include:

- Nanosonics Ltd (ASX: NAN)

- Propel Funeral Partners Ltd (ASX: PFP)

- Imdex Limited (ASX: IMD)

- Altium Limited (ASX: ALU)

I'm doubtful that some of the ASX dividend shares known for their 'safeness' could outperform these growing businesses over the next decade — let alone beat the index. That's why I believe it's important to remain diversified and maintain a balanced portfolio of growth and income.