It's been a wild journey for TPG Telecom Ltd (ASX: TPG) shares over the past few years. Acquisitions, court hearings, and attempted deals with their biggest competitor. If the telecommunications industry was your thing, you could almost make a movie from the twists and turns that TPG has traversed in recent times.

Once upon a time, I was a shareholder in TPG — impressed with its rise to prominence in a competitive market. The company held a spot in my portfolio for close to four years, commencing in April 2017.

I decided to sell out of my holding completely once all the dust settled on its merger with Vodafone. At that point, TPG was at the largest, and arguably, most competitive position in its history.

What was the thinking behind this decision?

Where it began

To understand why I eventually hit sell on my TPG shares, I need to explain why I originally invested in the underdog.

At the time, I was still green in terms of my investing experience. As with most newcomers, the speculative neck of the woods is where curiosity first led me.

However, I soon got a taste for value-orientated companies. Businesses that were proven, profitable, and showed promise for delivering shareholder returns exceeding that of the S&P/ASX 200 Index (ASX: XJO).

In my search, I stumbled upon a company I had heard of before, TPG. My partner — who lived in Sydney back then — was a TPG customer. She opted for NBN internet with them over the other big names, such as Telstra Group Ltd (ASX: TLS) and Optus, due to their cheaper pricing.

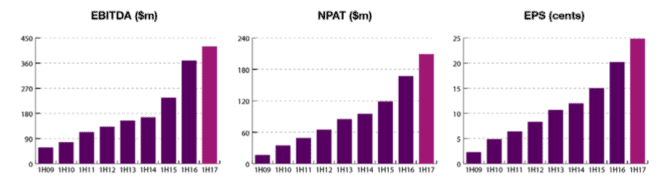

To my excitement, I found that TPG — despite undercutting its competition — was growing its net profits after tax (NPAT) at an incredible rate. Earnings were $207.5 million at the end of the first half of FY17. Comparatively, the company's first-half NPAT was $90.1 million only three years prior, as shown below.

In my eyes, here was a company that could deliver a competitive service at a cheaper price thanks to its growing participation in industry consolidation. Additionally, word on the street then was that TPG had plans to expand its successful campaign against the incumbents in the 5G mobile market.

It ticked my boxes: a history of a proven strategy, signs of competitive advantage, room for further growth, and an invested CEO steering the ship (founder David Teoh).

Why I sold my TPG shares

Fundamentally, the unravelling of my original investment thesis is what prompted me to sell my TPG shares in April 2021 for $6.10 apiece.

Firstly, the telecom provider's plans of delivering a low-cost 5G mobile network began to crumble in 2019 amid a ban on Huawei infrastructure. The China-made devices were intended to underpin TPG's competitive small-cell network.

Fortunately, TPG has managed to still tap into the opportunity through the merger with Vodafone Hutchinson Australia. However, I was concerned that Vodafone might come with some unwelcomed baggage given a series of $100 million-plus losses prior to the deal.

Furthermore, the entrepreneurial spark of David Teoh was extinguished on 26 March 2021 when the founder decided to resign.

Simply put, most of the factors that played into my justification for buying were now gone — or at minimum, far murkier than before. Feeling unconfident, it seemed only reasonable to sell my TPG shares and reassess my options.

Time to take another look?

Including dividends, TPG delivered a 15.2% total return over my holding period. Since selling, shares in the telco giant have netted a 12% loss after dividends.

I'm not going to claim that I knew the share price was going to fall, because I didn't. I was more at odds with the likelihood of TPG shares outperforming the Aussie benchmark over the next five years.

When I sold, I was not convinced that this Aussie internet provider could unlock enough value to beat an equal investment in something like a Vanguard Australian Shares Index ETF (ASX: VAS).

Credit where it is due, TPG has been growing its earnings and dividends while keeping debt under control, as pictured above. As a result, shares in the company now offer a respectable dividend yield of 3.6% at a 65% payout ratio.

If the second-largest internet provider is able to continue to steadily grow earnings by chipping away at the market share of Telstra and Optus, I'd consider making a spot for TPG shares in my portfolio again.

However, the competitive pressures from new retail service providers and emerging low Earth-orbiting (LEO) satellites leave me with reservations.

In conclusion, I believe I made a reasonable investment decision at the time. As famed investor Peter Lynch once said, "Know what you own, and know why you own it."

Following the changes at TPG, I personally no longer knew a solid reason for owning a piece of the company.