The Super Retail Group Ltd (ASX: SUL) share price is racing higher amid the release of its half-year results this morning.

Wasting no time, shares in the operator of retail brands SuperCheap Auto, rebel, BCF, and Macpac are drifting 5.3% higher to $12.60 in early trade. For context, the S&P/ASX 200 Index (ASX: XJO) is 0.52% stronger than yesterday.

It appears shareholders are still stoked with today's release, despite getting a glimpse into these figures back in January.

So, which metrics are making investors' hearts race?

Booming profits jump-start the Super Retail share price

- Group sales up 15% year-on-year to a first-half record of $1.96 billion

- Statutory net profit after tax (NPAT) up 30% to $144 million

- Normalised earnings per share (EPS) up 36% to 63.9 cents per share

- Fully franked interim dividend of 34 cents per share declared, up 26% from last year

- Finished the half with $212 million in cash and no drawn bank debt

Super Retail Group has delivered a solid result on behalf of its shareholders today with earnings at the top of its prior guidance.

According to the release, the record sales were aided by a strong trading period over Black Friday and the Christmas season. This, in conjunction with cost controls, resulted in the company delivering a significant increase in profits — up 30% compared to the prior corresponding period.

The biggest contribution — in terms of total sales growth — came from the company's Macpac division. This business segment achieved 55% sales growth year-on-year. Whereas the weakest momentum could be found in the BCF unit, which grew by 7%.

What else happened during the first half?

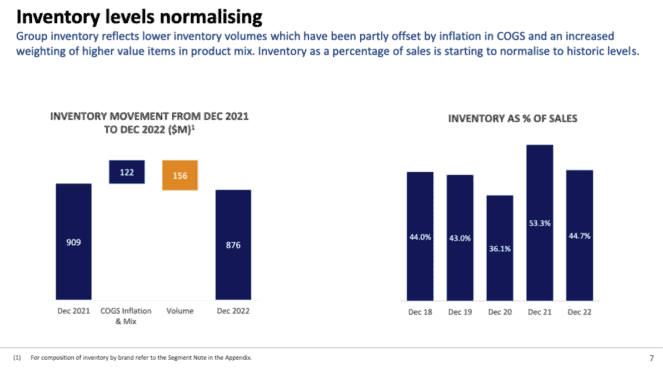

One aspect of retailing that has been a major headache for many companies is inventory levels. Holding excess inventory can be a costly practice. However, the need to mitigate supply chain issues prompted buying ahead of demand.

Fortunately, inventory levels further normalised during the first half, finishing the period at $876 million. This could be playing into the stronger Super Retail share price today.

As the slide above shows, inventory represented 44.7% of group sales at the end of December 2022 — more in line with pre-pandemic values.

What did management say?

In acknowledging the accomplishments of the first half, Super Retail Group CEO Anthony Heraghty said:

This result is a testimony to the strength of our four core brands, all of which delivered record first-half sales off the back of strong peak period trading. The success of our new store formats (including rebel rCX and the new BCF superstore) and our club member programs, which have added one million members in the past 12 months, have helped to deliver a strong first-half performance.

Shifting gears to the second half, Heraghty noted the positive signs so far, stating:

Pleasingly, the strong sales momentum we saw in the first half has continued into January, with all

brands trading well.

Though, the forward outlook isn't without its drawbacks.

What's next?

The second half is already showing signs of positive performance. On a year-to-date basis, sales for each of the company's four brands are positive on a like-for-like comparison.

Furthermore, management is targeting the opening of 18 new stores during the current half. In particular, Super Retail is expanding its rebel 'rCX' store format by an additional two stores, which would bring the total count to 15.

However, the company's CEO noted a potential headwind from rising interest rates in the second half. A higher rate environment could lead to weaker consumer spending, translating into dampened group sales.

Super Retail share price snapshot

The performance of the Super Retail share price remains negative over the past year. Although, the last six months have been a completely different story.

Those that invested in this ASX share six months ago are already up nearly 22%. And, despite the substantial rally, the company's price-to-earnings (P/E) ratio is relatively conservative at 11.7 times.