This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

Shares of e-commerce giant Amazon (NASDAQ: AMZN) were down more than the markets today, declining 2.9% as of 11:30 a.m. EDT.

While the broader tech indexes were down as investors appeared to be trimming gains from the recent run-up in stocks, Amazon fell more, perhaps due to a negative Wall Street Journal article on the e-commerce giant regarding some recent customer satisfaction surveys.

So what

On Monday, the Wall Street Journal published an article on its home page whose thesis is that customer satisfaction at Amazon's e-commerce unit might be waning. Right ahead of the holidays, that's not a great headline, certainly for a company that preaches "customer obsession."

The article cited three broad customer satisfaction surveys.

- First, Evercore ISI held its regular survey of Amazon customers, revealing that the proportion of customers that considered themselves "extremely" or "very satisfied" with Amazon came in at "just" 79%. While that's higher than in the depths of the pandemic, when there were widespread delays, it is down from the peak rate of 88% from one decade ago.

- Furthermore, a different survey from the American Customer Satisfaction Index gave Amazon a score of 78 out of 100, its worst performance since 2000.

- Finally, consulting firm Brooks Bell also conducted a study of 1,000 Amazon customers, finding that roughly one-third reported late deliveries or products of low quality.

The findings are certainly concerning, since the general step-down in satisfaction is showing up in three different surveys. Of course, the effects of the pandemic are still being felt in terms of labor shortages and other factors. Furthermore, competing e-commerce sites don't have nearly the volume that Amazon does, nor do they make the promises Amazon does, such as the recent push for one-day shipping. Amazon has kept ratcheting up its promises, giving it a higher bar to clear.

Still, there might be real problems here. The increase in third-party sellers on the platform could be causing some issues with product quality. Also, the ramp-up in advertising on the website could complicate customer searches if results are overloaded with ads from irrelevant or lower-tier brands. And the automation of customer service could be frustrating to people who wish to easily speak with a human being.

Amazon likely can't afford to pull back on those elements, because third-party sales have grown at a higher pace than first-party items, and advertising revenues have been one of the bright spots in Amazon's earnings results over the past few quarters, even as e-commerce has struggled more broadly. The e-commerce unit has also dipped back into losses, so investing heavily in more in-person customer service would also increase costs.

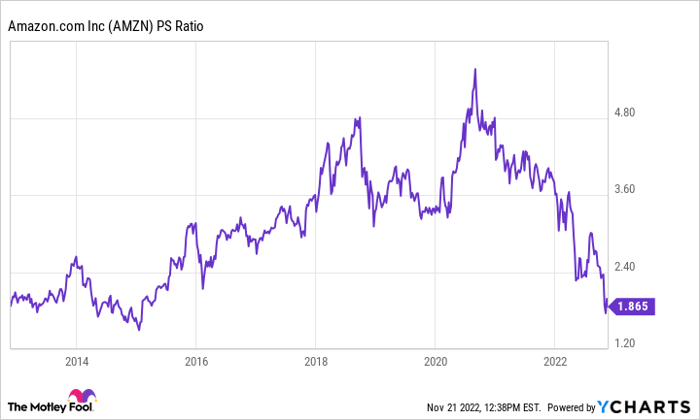

AMZN PS Ratio data by YCharts.

Now what

The recent survey results aren't a reason for long-term Amazon investors to panic even though the stock is down more than the market today. The WSJ notes that Amazon spent $1 billion last year combating counterfeiters, fraud, fake reviews, and other bad actors on the platform. Just a couple weeks ago, Amazon's Counterfeit Crimes Unit helped identify and disrupt three major counterfeit networks in China, where 240,000 fake items were seized by authorities. Commenting on the WSJ article, an Amazon spokesperson also noted high ratings for its mobile app.

Amazon also has a history of tackling problems head-on and doing the difficult work to overcome them, which is why it's enjoyed such long-term success. However, investors should keep a watch on these customer surveys as well as announcements from Amazon and its management team about how they are going to improve on these issues.

After a brutal year for tech stocks and with a potential recession looming, Amazon's valuation on a price-to-sales basis is now the lowest it's been since early 2015, just before it broke out the results from Amazon Web Services. As long as Amazon isn't in terminal decline -- and I don't think it is -- shares are looking like quite the deal these days for long-term-oriented investors.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.