This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

While international stocks have been quite tumultuous this year, the story of South African investment company Naspers (OTC: NPSNY) and its associated investee, Prosus (OTC: PROSY), keeps getting better.

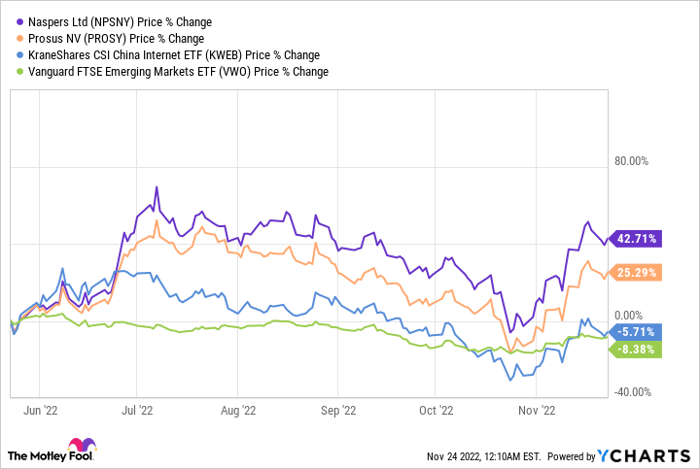

While investors in this conglomerate have had a difficult few years, both Naspers and Prosus have greatly outperformed both the KraneShares CSI Chinese Internet ETF (NYSEMKT: KWEB) as well as the Vanguard FTSE Emerging Markets ETF (NYSEMKT: VWO) over the past six months.

These two companies have a somewhat complex cross-holding structure, but they are essentially large part-owners in the same set of assets, with Prosus shareholders owning 57% of the portfolio, and Naspers owning about 43%.

The largest asset of the combined company is its 27.3% ownership in Chinese internet giant Tencent (OTC: TCEHY), which accounts for about 75% of the portfolio. However, Naspers/Prosus also owns a portfolio of other growth businesses, including online classifieds and food delivery companies in Europe and South America, fintech assets in India, and education technology companies in both the U.S. and internationally.

The company's earnings report for the first half of fiscal 2023 had good news on just about every single front. Assuming the combined company can execute on its plans, its outperformance may just be getting started.

The new sale and buyback strategy is all going according to plan

Despite management's best efforts, the discount at which Naspers/Prosus trade in relation to their assets had widened over the years, much to the frustration of its investors, Yours Truly included.

Yet Naspers/Prosus' recent outperformance came after management announced a decisive step in June. Starting in June, management began selling little bits of its Tencent stake and simultaneously repurchasing shares of both Prosus and Naspers. Given that Prosus and Naspers stocks were trading at huge discounts the value of their Tencent stake at the time – never mind all the other assets – that move immediately added to the per-share value of the company.

Since then, management has been able to repurchase 7% of Prosus' and 5% of Naspers' shares outstanding, while selling a lower percentage of Tencent. So while the company's overall stake in Tencent fell, Naspers and Prosus shareholders actually now have 1.4% more exposure to Tencent on a per-share basis than five months ago.

It also helps that Tencent has begun repurchasing its own stock in significant quantities this year as its share price has fallen. So Naspers and Prosus aren't even losing as much exposure to Tencent as their sales would indicate.

A near-7% stock dividend is coming

The news gets even better, since Tencent recently announced it would be spinning off its 17% stake in Chinese food delivery and travel platform Meituan (OTC: MPNG.Y) to shareholders, probably because of regulatory pressure from the government. Prosus' management estimates it will receive roughly $5.4 billion worth of Meituan shares when the spinoff happens next March.

That would increase Prosus' asset base by 4.3%, but given that Prosus shares currently trade at a 33% discount to its estimated net asset value, the upcoming Meituan dividend will amount to a nearly 7% dividend of Meituan shares, based on where Prosus shares trade now.

The other businesses will turn profitable by mid-2024

As Prosus/Naspers is now selling down its Tencent stake, management hopes to refocus the company on its other assets. These consist of a collection of both wholly owned businesses, as well as large stakes in other publicly traded companies across online classifieds, food delivery, fintech, education tech, and e-retail.

That conglomerate setup is not unlike Warren Buffett's Berkshire Hathaway, except for one thing -- Prosus' other big segments aren't profitable. So, the company has had to feed these businesses, with the only cash coming from Tencent's dividend or other asset sales. That's different from Buffett's Berkshire, which has profitable operating and insurance businesses that constantly kick cash back to headquarters for redeployment.

However, given the current economic environment, Prosus management is looking to change that. For the first time, Prosus' management gave specific projections for when consolidated operations -- those being its wholly owned or majority-owned businesses -- would become profitable.

The target for profitability is the first half of fiscal 2025, which is the March-September 2024 quarter.

To that end, management increased some investments in its most promising markets while pulling out of others. For instance, while Prosus just bought out the remaining 33.3% stake in Brazil's iFood for another $1.5 billion, it also pulled out of iFood's Colombia business. Prosus also exited its OLX auto trading platform in Peru and Ecuador.

While the non-Tencent segments collectively grew revenue an impressive 35.2% to $5.2 billion over the past six months, despite the strong dollar, their trading losses also expanded from ($522 million) to ($998 million). However, management pledged that profitability would improve from here going forward, as some one-time investments were accelerated in the last half-year.

We'll see if management is able to hit that profitability target in time; however, given the strong revenue growth across those segments despite economic troubles abroad, it seems a decent bet that those profit targets can be hit with greater scale -- especially now that management is laser-focused on profits.

What will it mean for the stock?

If management can get the non-Tencent parts of the business to become profitable, it could be a big deal. Not only will Prosus get a stream of regular profits to either repurchase stock or make new investments, instead of having to sell more Tencent, but perhaps it would cause investors to view the conglomerate as something more than just a derivative play on Tencent.

If that happens, the outsized gains of the past six months could be a sign of things to come, especially given the still-huge discount to net asset value.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.