The S&P/ASX 200 Index (ASX: XJO) finished up 1.4% on Thursday at 6,555 points.

In the year to date, the benchmark index has dropped almost 14% as the market grapples with the challenges of rising inflation and interest rates. This means only one thing: Volatility.

As reported by CNBC, staying invested during volatility is difficult but crucial for share investors, according to Mary Callahan Erdoes, the CEO of JPMorgan Asset & Wealth Management.

At CNBC's Delivering Alpha investor summit in New York, Erdoes said:

While the world is focused on all the black swan events, there will be white swans that emerge.

Keeping your eye out for those white swans and … staying invested in these markets is one of the most important things and one of the most difficult things.

Stand by for some industry lingo

Before we go any further with Erdoes' comments, here's a quick reminder on the following fin-speak.

- The term 'black swan' describes a market-moving event that no one saw coming. Case in point: COVID-19

- The term 'white swan' is a predictable crisis that can be addressed

- The term 'alpha' means returns that beat the general market (we'll talk about alpha in a sec)

Got that? Okay, here's some more from Erdoes.

There's 'alpha everywhere'

Erdoes says investors should search the market for opportunities. She said:

There is alpha everywhere. It's in stocks. It's in bonds. It's in currencies. It's in real estate. It's in private markets. It's in public markets. It's everywhere, because we are in such a state of change.

Erdoes is an expert, so she's going to look far beyond her home market for opportunities. Some ASX share investors do the same, so let's check out her views on international stocks.

Erdoes said:

Don't fight investing in China. It's a country that is going to emerge from COVID. It's a country that is going to put its 22% youth employment back to work. It's an economy that is going to continue to invest in EVs, semis, et cetera.

She also likes United Kingdom banking stocks, adopting a Buffett-esque view of being 'greedy only when others are fearful'.

She said:

Last week people said don't invest in a single thing in the UK. That is exactly when people like us, and people in the room, think, 'Let's go look right there'.

Let history be your guide

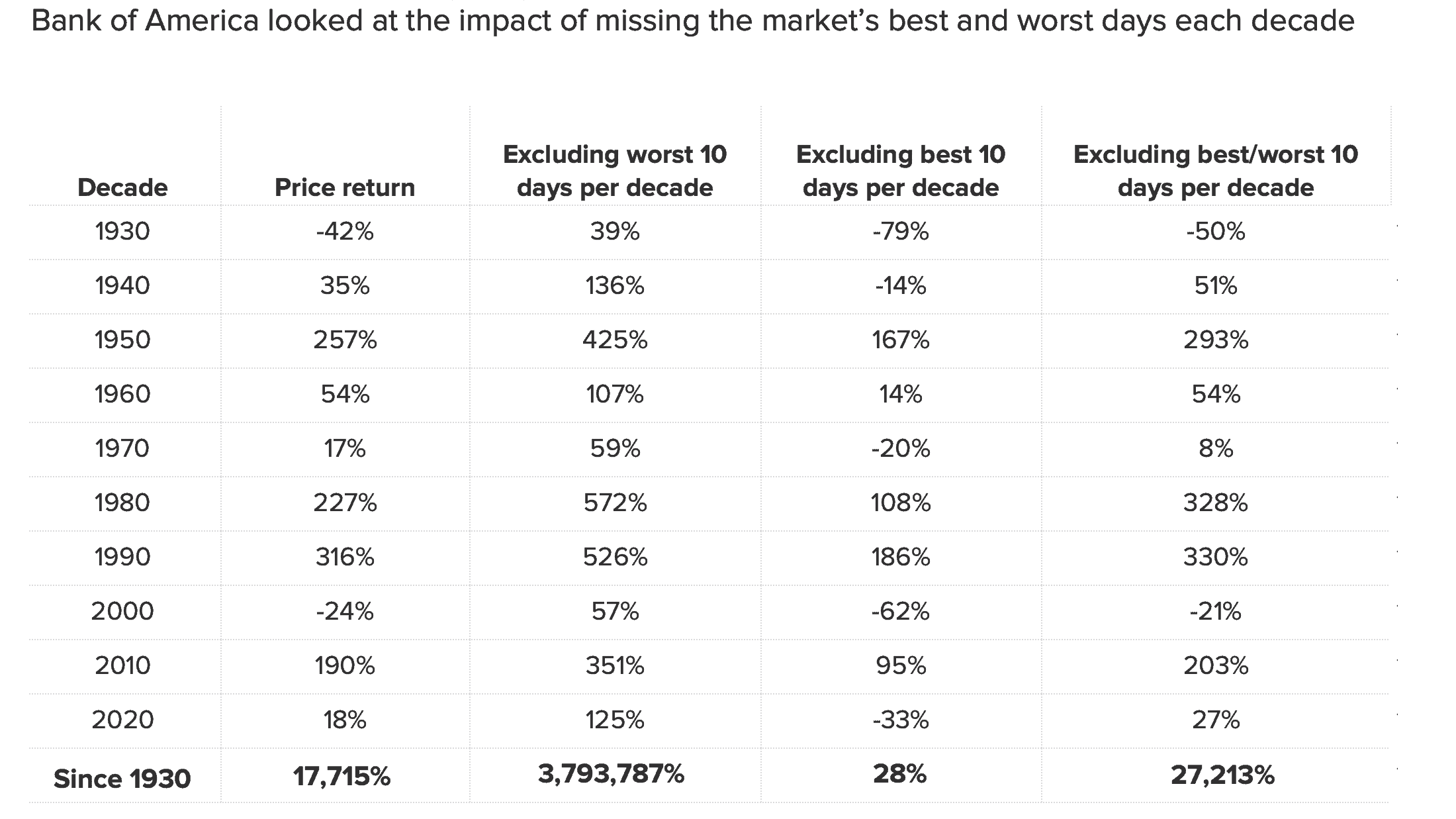

The following table published by CBNC demonstrates how staying in the market has worked at various historical points. What it does is ensure you are in the market on its best days of recovery.

While this data represents the S&P 500 in the US, the same principle applies to ASX shares, too.

Source: cnbc.com