This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

It's official. Last week the S&P 500 joined the Nasdaq Composite and fell firmly into bear market territory, meaning it is more than 20% down from its recent high. For many investors, it's unnerving to be in the midst of a collapsing market. It seems like every day there is doom and gloom and another "expert" with another hot take on why it's down and when it will go back up.

What you need to know is that no one knows when the downturn will end. The best assurance we can offer is that it will end. When the bull returns, you need to be ready to take it by the horns. Long-term investors can use a bear market to their distinct advantage. After all, good investors don't want to buy high and sell low, right?

Let's look at the qualities you are likely to find in a down-trending stock that will help it rise again. Qualities like profits, cash flow, seasoned management, and growth opportunities all come to mind. Microsoft (NASDAQ: MSFT) has all of these in spades.

Microsoft has seasoned management for turbulent times

Microsoft CEO Satya Nadella heads up a team that has done impressive work recently. We need only go back to March 2020 to see this leadership in action. With significant economic uncertainty, Microsoft posted record revenue and operating profits for shareholders.

Data source: Microsoft. Chart by author.

The company has built on these gains through the first three quarters of fiscal 2022 (Microsoft's fiscal year ends in June). One of the biggest testaments to a well-run organization is its profitability. Microsoft is hugely profitable and continues to grow margins, as shown below. For comparison, Alphabet posted an operating margin of 31% in 2021 -- a very successful year for the company.

Data source: Microsoft. Chart by author.

Microsoft's management team has proven its mettle to navigate our current economic challenges.

Microsoft has its head in the clouds

Microsoft continues to dominate the software industry with its leading Office and Windows products, but its future resides in the cloud. Cloud infrastructure spending is exploding, and it is forecast to grow 20% this year, according to Gartner. Microsoft's cloud infrastructure platform Azure is locked in a battle for supremacy with Amazon's AWS.

This sector is highly lucrative. Microsoft's Azure and other cloud services segment grew an astounding 46% year over year in the last quarter to go along with the company's server products and cloud services' 29% growth. In total, the Intelligent Cloud revenue stream produced $54.3 billion of Microsoft's $146.4 billion in sales through Q3 FY22.

Another terrific quality of Microsoft is that the company never allows itself to become stagnant. Rather than be satisfied with recent results, the company announced the blockbuster acquisition of Activision Blizzard (NASDAQ: ATVI) for $69 billion earlier this year.

Activision will bring popular gaming franchises like Call of Duty, Candy Crush, and StarCraft. It will make Microsoft the third-largest gaming company by revenue if the deal receives regulatory approval. These impressive forays into cloud computing and gaming make Microsoft a leader in two more fast-growing fields.

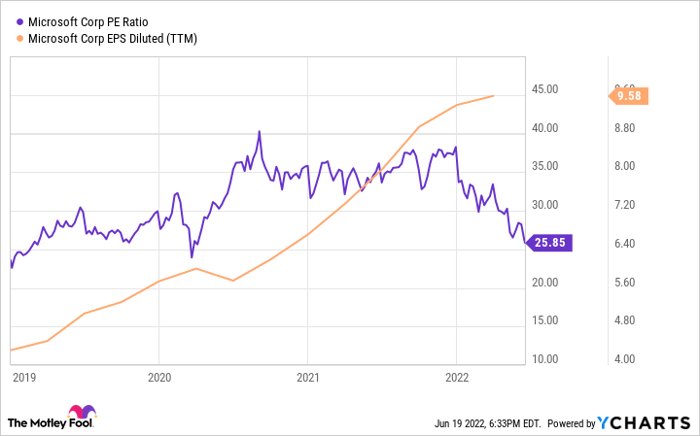

Microsoft is generating its cheapest valuation in years

Microsoft stock isn't immune to the market swoon, even though its results remain stellar. The stock is down over 25% this year. This has brought the price-to-earnings (P/E) ratio down to its lowest level since the March 2020 crash and, before that, early 2019. Meanwhile, earnings continue to rise, as shown below.

MSFT PE Ratio data by YCharts

Investors can also pocket a small but growing dividend. The company's dividend has increased annually since 2006 and is yielding around 1% at the moment.

No stock is without risk as recession fears linger on the horizon, and Microsoft stock could continue to decline with the market. It's unlikely to catch a stock at its lowest price; predicting this accurately is nearly impossible. An incremental buying strategy, like dollar-cost averaging, is an excellent way to mitigate short-term market risk.

Microsoft has all the qualities investors look for in a long-term winner and is firing on all cylinders. The stock has rewarded long-term shareholders for years, which appears ready to continue once the bear goes back into hibernation.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.